Subex | The company reported lower profit at Rs 4.82 crore in Q2FY22 against Rs 12.25 crore in Q2FY21, revenue fell to Rs 86.3 crore from Rs 93.3 crore YoY.

The market ended lower for the second consecutive week after investors opted for profit booking on stretched valuations, which also saw foreign institutional investors go on a selling spree.

In the week ended October 29, the BSE Sensex fell 1,514.69 points (2.49 percent) to close at 59,306.93, while the Nifty50 shed 443.2 points (2.44 percent) to close at 17,671.7 levels. The Sensex and Nifty, however, added 0.30 percent each in October.

The broader indices—BSE midcap and Smallcap indices— shed a percent each in the previous and ended flat for the month.

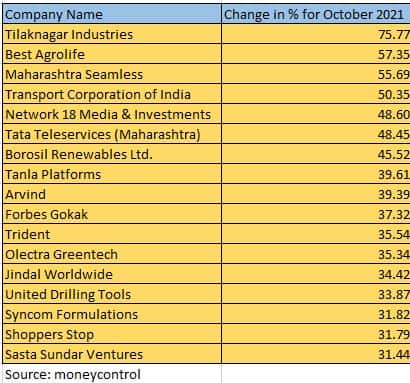

In October, more than 132 smallcaps, including Tilaknagar Industries, Best Agrolife, Maharashtra Seamless, Transport Corporation of India, Network 18 Media & Investments and Tata Teleservices (Maharashtra), added 10-75 percent.

On the other hand, 100 stocks lost 10-56 percent. These included SREI Infrastructure Finance, Panacea Biotec, McLeod Russel (India), Balaji Amines, PNB Housing Finance, Solara Active Pharma Sciences and Gujarat Themis Biosyn.

"Despite a flat start to the week, domestic markets lost ground to slip into negative territory, tracking dull global cues and mixed corporate earnings. Continuous selling by FIIs during the week fanned investor cautiousness," said Vinod Nair, Head of Research at Geojit Financial Services.

Global markets turned weak though the European Central Bank kept policy rates unchanged despite the inflationary pressure, while slow GDP growth in the US tested investor confidence, he said.

"Private sector banks witnessed a fatigue week, although the sector witnessed improvement in business along with better asset quality," Nair said.

During the week, the BSE 500 index lost over 2 percent with IRB Infrastructure Developers, Rail Vikas Nigam, Vaibhav Global, Adani Power, RBL Bank and Indus Towers falling 10-23 percent.

“The equity markets trended lower for the week owing to selling pressure from FIIs. The FIIs have been net sellers to the tune of more than Rs 20k crore for the month of October," said Joseph Thomas, Head of Research, Emkay Wealth Management.

The valuation risks have been one the main concerns for foreign investors, triggered by the downgrading of Indian equity markets from “overweight” to “neutral” by key global brokerages.

"The valuation risks are specifically coming to the fore now as few sections of the markets expect growth momentum to slow in the wake of sticky inflation,” he added.

Where is Nifty50 headed?

Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One

Going ahead, since the market is a bit oversold, we may see some relief move in between but traders should not get carried away by such rebounds.

On the higher side, 18,000–18,100 would now be seen as immediate hurdles and any bounce back towards it, should be used to lighten up longs.

On the flip side, we may see this corrective move extending towards 17,450 first and if things worsened then the possibility of sliding towards 17,200–17,000 cannot be ruled out.

We reiterate staying light and avoiding any kind of bottom-fishing for a while.

Yesha Shah, Head of Equity Research, Samco Securities

Though the trading week ahead will be shorter, it can undoubtedly be eventful. The news flow and market sentiment may be dominated by the upcoming FOMC meeting.

While investors appear to have priced in the possibility of tapering by mid-November, the focus will now shift to the timing of interest rate hikes.

Indian automakers will report their monthly sales figures. Despite the festival season, shortages of semiconductors, rising freight and commodity prices may continue to squeeze margins and weaken sales.

Ajit Mishra, VP-Research, Religare Broking

Earnings disappointment combined with feeble global cues is weighing on the sentiment.

Apart from the earnings announcements, participants will be closely eyeing the upcoming US Federal Reserve meeting and auto sales numbers for cues.

Indications are of further slides, so participants should maintain a cautious approach and prefer a hedged approach.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

We are of the view that the short-term trend remains weak due to the oversold situation in the market. The weekly trading set-up suggests 17,800 would be the immediate hurdle for the Nifty. If it succeeds to trade higher, we can expect a pullback rally up to 17,920-18,000-18,070.

On the flip side, below 17,800, the correction wave may continue up to 17,600-17,500-17,420 levels.

The Bank Nifty is trading near the 20-day SMA, and on daily charts it has maintained strong formation. The key supports for the Bank Nifty are placed at 38,400 and 38,000, while the structure suggests further upside if it succeeds to trade above 38,400.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Market losses over 2% amid profit-booking during the week, end month a tad better - Moneycontrol.com

Read More

No comments:

Post a Comment