India VIX was up in the green. (Image: REUTERS)

India VIX was up in the green. (Image: REUTERS)

Share Market News Today | Sensex, Nifty, Share Prices LIVE: Domestic equity markets began trading in the green on Monday morning, looking to recover some of last week’s losses. S&P BSE Sensex was above 59,600 while Nifty 50 was above 17,800. Broader market were mirroring the up-move and India VIX was up in the green. Bank Nifty was up 0.62% above 39,300 points. Tata Steel and Bharti Airtel were the top gainers on Sensex, up more than 2% each. Bajaj Finserv, Mahindra and Mahindra, and Nestle were the top laggards, falling more than 1% each.

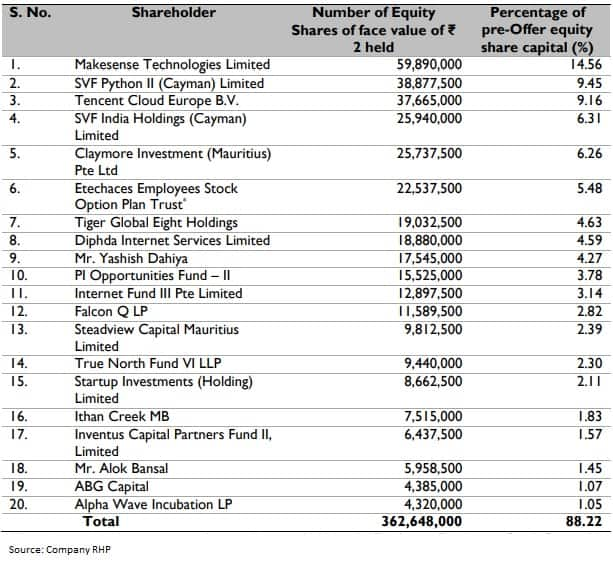

IPO market will witness heavy action this week as 3 new public issues open for subscription. Along with the new IPOs, Nykaa’s issue will close today after witnessing strong interest from investors, who oversubscribed the IPO on the first day of sale. Policybazaar, SJS Enterprises, and Sigachi Industries are the three new IPOs opening for subscription today and will close on Wednesday.

Manufacturing sector growth in India gained steam in October as companies scaled up production in line with a substantial upturn in new work intakes. Firms stepped up input purchasing amid stock-building efforts and in anticipation of further improvements in demand, while business optimism hit a six-month high. Panellists continued to report rising prices for several materials and transportation, with overall input costs increasing at the sharpest rate since February 2014. Subsequently, selling charges were lifted again. At 55.9 in October, the seasonally adjusted IHS Markit India Manufacturing Purchasing Managers’ Index (PMI) was in expansion territory for the fourth month in a row. Moreover, rising from 53.7 in September, the latest figure pointed to the strongest improvement in overall operating conditions since February.

In Samvat 2077, equity markets had a historical move as the benchmark indices touched new lifetime highs of 18000 and 62000 mark for the first time in history. Last year, the Sensex closed at 43,443 on the day of Diwali of Samvat 2076 and had gained 4,385 points or 11.23% in the past year. The Sensex has seen a record high of 62,245 in Samvat 2077, which was up 18,607 points or 42.6% from the previous Diwali. The key factors in driving the market were improved macro indicators, strong global liquidity, increased economic activities, significant pickup in vaccination, improvement in the consumption-related data, ease in monetary policy and sharp recovery in corporate earnings.

We expect buying demand to emerge around the key support threshold of 17500 in the upcoming truncated week and undergo a higher base formation that would make market healthy after a 20% rally seen over the past three months. Such intermediate episodes of breather make larger sutural up trend healthy as seen in previous bull markets. Thereby, the ongoing corrective phase should not be construed as negative, instead dips should be capitalized to build a quality portfolio over the medium term.

Nifty ATM call option IV is currently 19.03 whereas Nifty ATM Put option IV is quoting at 13.08. Index options PCR is at 0.90 v/s 0.90 & F&O Total PCR is at 0.81. Nifty Put options OI distribution shows that 17000 has highest OI concentration followed by 17500 & 17800 which may act as support for the current expiry. Nifty Call strike 18000 followed by 17800 witnessed significant OI concentration and may act as resistance for current expiry.

"A pull back is in order, aiming 17833 initially but Nifty does not look primed for a vertical rise. While a push towards 17966- 18020, may be expected, the 18170-400 region appears could again prompt a distribution and aim for 17350, our downside objective that has been in play for a fortnight now. Meanwhile, a direct fall below 17600 today may not lead to a collapse, but in turn, lead to a consolidation in the 17500-350 band in the next few days, which could improve the chances of a sustainable uptrend."

~ Geojit Financial Services

Commodity prices traded weak with most of the commodities in non-agro segment witnessed selling in the last trading session of the week. Bullion prices pared weekly gains on stronger dollar while crude oil prices ended flat on mixed global cues. Base metals traded lower on eased worries over power shortage in China and demand concerns with rising CPVD cases in China.

"The market went through a minor correction of above 3% in the Nifty during the last two trading days. The sell-off in the broader market was steeper with Nifty Midcap Index correcting 8% from the peak. The trigger for the correction has been the sustained FII selling during the last 9 trading days following the downgrading of India by some leading foreign brokerages like UBS and Nomura who are concerned about excessive valuations. The depository data shows FII selling in equity at Rs 13550 cr, the highest for a month, so far, in 2021. The massive FII selling appears to have overwhelmed the newbie retail investors who have been merrily buying every dip. An important factor that might influence the market is the new IPOs hitting the market this week. Heavy oversubscriptions in attractive IPOs are draining money from the secondary market. So, FII selling and IPOs have emerged as headwinds for the market in the short-term. Investors may wait for the market to consolidate before taking fresh investment decisions," said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Domestic markets opened in the green on Monday morning. Broader markets were mirrored the up-move. Airtel was the top Sensex gainer on opening bell.

Sensex gained 270 points in pre-open session on Monday while Nifty 50 neared 17,800.

"On the technical front, Nifty 50 is currently trading at a very good support zone near 17,500 -17,700 and we believe markets may show some good recovery from these levels. the 18,000 level is an immediate hurdle on upside for Nifty 50," said Mohit Nigam, Head - PMS, Hem Securities.

"Nifty needs to reclaim 17,800 today for any meaningful recovery to happen or else any attempt by bulls might go in vain. One last gap, the island reversal gap, should get filled at 17,557+ put writers support at 17,500 makes it a possible bottom fishing zone for this week," said Rahul Sharma, Director & Head - Research, JM Financial.

'Nifty is expected to open flat to positive at 17700, up by 30 points. Nifty has support at 17600 and 17450 levels and resistance at 17950 and 18050 levels. Traders are suggested to avoid long positions till the time Nifty trades above 18350,' Gaurav Udani, CEO & Founder, ThincRedBlu Securities.

Tata Motors, IRCTC, Aditya Birla Capital, Bajaj Consumer Care, Bayer Cropscience, Chambal Fertilisers & Chemicals, Indian Railway Finance Corporation, JBF Industries, Kalyani Steels, Lux Industries, Man Infraconstruction, Mold-Tek Technologies, Mold-Tek Packaging, Nilkamal, Parag Milk Foods, Punjab & Sind Bank, Relaxo Footwears, Rolta India, Rupa & Company, Shipping Corporation of India, Sun Pharma Advanced Research Company, Star Cement, Sterling Tools, Tata Motors – DVR, Venky’s (India), and VRL Logistics, among others were scheduled to announce their Jul-Sep quarter earnings.

Petrol and Diesel Rate Today in Delhi, Bangalore, Chennai, Mumbai, Hyderabad: The price of petrol and diesel were increased by oil marketing companies for the sixth consecutive day on Monday. Petrol in the national capital today costs Rs 109.69 per litre, up by 35 paise since yesterday. Meanwhile, diesel in the capital city was retailing at Rs 98.42 per litre, a 35 paise increase. Petrol and diesel rates were increased 23 times in October. Bharat Petroleum Corporation Ltd (BPCL), Indian Oil Corporation Ltd (IOCL) and Hindustan Petroleum Corporation Ltd (HPCL) revise the fuel prices daily in line with benchmark international price and foreign exchange rates.https://www.financialexpress.com/market/commodities/petrol-and-diesel-price-november-1-fuel-rates-hiked-for-6th-day-straight-check-price-in-delhi-mumbai-here/2360807/

The Indian equity market finally seems to be witnessing the much-awaited correction, although the headline index is getting some support from the healthy performance of the financials. However, this is masking the weakness in the broader market, especially in the midcap and small cap space. While the respective indices have corrected by ~8-10%, we have seen much sharper cuts in several individual names. Over the past couple of months, we have been seeing more of small intermittent corrections within the market at sectoral level, rather than at the headline index level. The broader markets, however, had continued to do quite well, with expectations running quite high, leading to some froth getting built up. Past few days have seen some shakeout in the markets, which was necessary to make the markets healthier.

BSE Sensex and Nifty 50 were set to open to in the positive territory on Monday, as suggested by trends SGX Nifty in early trade. In the previous session, Sensex tumbled 677.77 points or 1.13 per cent to close at 59,306.93. The NSE Nifty 50 index closed 185 points or 1.04 per cent in red at 17,671. A host of factors such as domestic macroeconomic data announcements, quarterly earnings, oil prices, rupee movement, and other global cues will be the major sentiment drivers for the equity market in a holiday-shortened week ahead. Due to the festival of Diwali, markets will witness a truncated three-day trading session this week.

Stocks edged higher on Monday, led by a post-election jump in Japan’s Nikkei, though bonds wobbled and the dollar firmed as traders braced for central bank meetings in Britain, Australia and the United States to define the rates policy outlook. Japan’s Nikkei rose 2.3% to a one-month high after Prime Minister Fumio Kishida’s Liberal Democratic Party did better than expected at Sunday’s election, with exit polls showing the party easily retaining a majority.

PB Fintech Limited, the parent company of Policybazaar, allotted 26,218,079 equity shares to 155 anchor investors and raised Rs 2569.37 crore ahead of the company’s proposed IPO at the upper price band of Rs 980 per equity share.

"We are seeing profit taking for the last two weeks and indications are pointing towards a further slide. Nifty has immediate support at 17,550 and its breakdown may push the index to the 17,350 zone. In case of any rebound, it would face hurdles around 17,950-18,100 levels. Keeping in mind the prevailing trend and excessive volatility, it’s prudent to maintain extra caution in the selection of stocks and prefer hedged positions," said Ajit Mishra, VP Research. Religare Broking.

SGX Nifty was in the green on Monday morning, hinting at a flat to positive start to the day's trade.

IPO investors are in for a busy week. Nykaa' IPO will close today while 3 new public issues will open for subscription.

Share Market LIVE: Sensex off day’s high, still in green, Nifty gives up 17750; Tata Steel, Bharti Airtel gain - The Financial Express

Read More