The market had a historic day as the BSE Sensex closed above the 60,000-mark for the first time on the September 24 despite the weakness in global peers. The upward momentum was backed by buying in IT, select banking & financials and auto stocks.

Both the benchmark indices ended at record closing high. On September 24, the BSE Sensex jumped 163.11 points to 60,048.47, while the Nifty50 rose 30.25 points to 17,853.20 and formed bearish candle on the daily charts as the closing was lower than opening levels. During the week, the BSE Sensex gained 1.75 percent and Nifty50 rose 1.5 percent, continuing uptrend for fifth consecutive week.

"Trading was mostly rangebound with a positive bias but the highlight of the trade was Sensex breaching the psychological 60,000-mark. Benchmark Nifty has formed a robust higher high and higher low formation which is broadly positive. The important point is the index successfully cleared the resistance of 17,800 and is comfortably trading above the same," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

For the Nifty50, he feels 17,775-17,700 could be the important support levels. On the flip side, 18,000 and 18,200 could act as a major resistance level, he said.

Chouhan advised that contra traders can take a long bet near 17,700 with a strict 16,650 support stop loss, while partial profit booking is advisable between 18,100 to 18,200 level.

The broader markets ended mixed with the Nifty Midcap 100 index falling 0.78 percent and Smallcap 100 index up 0.12 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,799.17, followed by 17,745.13. If the index moves up, the key resistance levels to watch out for are 17,927.47 and 18,001.73.

Nifty Bank

The Nifty Bank gained 58.60 points to close at 37,830.30 on September 24. The important pivot level, which will act as crucial support for the index, is placed at 37,636, followed by 37,441.7. On the upside, key resistance levels are placed at 38,068.6 and 38,306.9 levels.

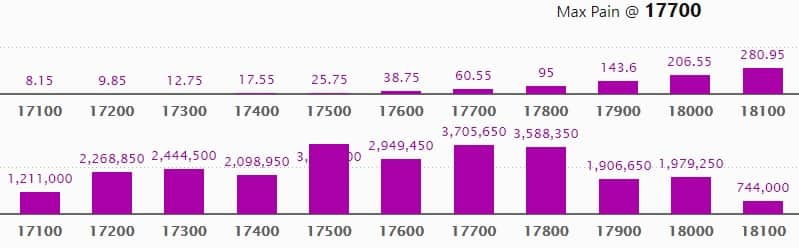

Call option data

Maximum Call open interest of 56.12 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level in the September series.

This is followed by 18000 strike, which holds 53.40 lakh contracts, and 17900 strike, which has accumulated 34.46 lakh contracts.

Call writing was seen at 18500 strike, which added 20.51 lakh contracts, followed by 18000 strike, which added 18.21 lakh contracts and 17900 strike which added 18.10 lakh contracts.

Call unwinding was seen at 17700 strike, which shed 5.45 lakh contracts, followed by 17800 strike, which shed 4.83 lakh contracts, and 17600 strike which shed 2.69 lakh contracts.

Put option data

Maximum Put open interest of 37.45 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the September series.

This is followed by 17700 strike, which holds 37.05 lakh contracts, and 17800 strike, which has accumulated 35.88 lakh contracts.

Put writing was seen at 17900 strike, which added 16.34 lakh contracts, followed by 17700 strike which added 8.19 lakh contracts, and 17800 strike which added 7.57 lakh contracts.

Put unwinding was seen at 17600 strike, which shed 36,900 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

18 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

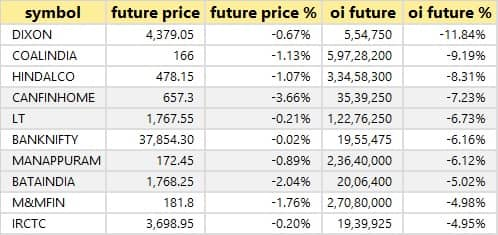

69 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

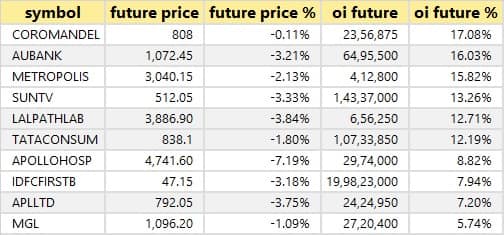

62 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

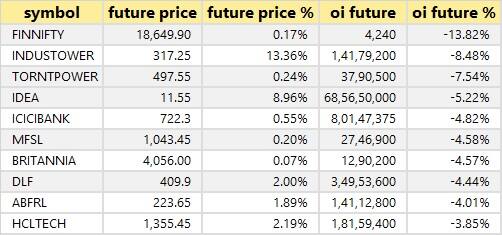

24 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

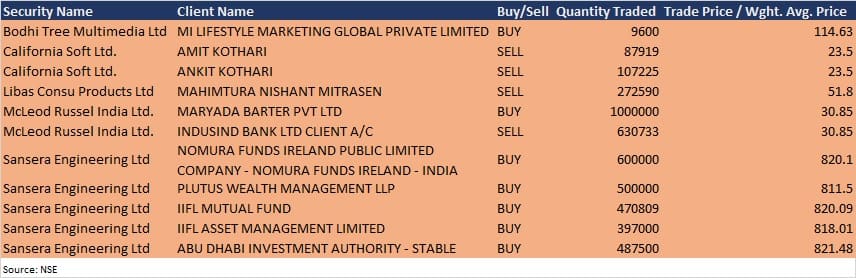

Bulk deals

Sansera Engineering: Nomura Funds Ireland Public Limited Company - Nomura Funds Ireland - India Equity acquired 6 lakh shares in the company at Rs 820.1 per share, Plutus Wealth Management LLP bought 5 lakh shares at Rs 811.5 per share, IIFL Mutual Fund bought 4,70,809 equity shares at Rs 820.09 per share, IIFL Asset Management purchased 3.97 lakh shares at Rs 818.01 per share, and Abu Dhabi Investment Authority - Stable acquired 4,87,500 equity shares at Rs 821.48 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Max Ventures and Industries: The company's officials will meet Equirus Capital on September 27, and Antique Stock Broking on September 28.

PSP Projects: The company's officials will meet Kotak Securities on September 27.

Brigade Enterprises: The company's officials will interact with analysts and institutional investors in Real Estate Conference organised by Antique Stock Broking on September 27.

Tata Motors: The company's officials will meet Jet Age Securities, and SBI Life Insurance on September 27, Thornburg Investment Management on September 28, and East Bridge Advisors on September 30.

Manappuram Finance: The company's officials will meet Point72 on September 27.

Gulshan Polyols: The company's officials will meet UTI AMC on September 27 and HDFC MF on September 28.

Hinduja Global Solutions: The company's officials will meet Ventura Securities on September 28.

Cipla: The company's officials will meet Sanford C Bernstein (India), and investors in Citi - India Healthcare and Pharma Virtual Investor Trip on September 29.

Stocks in News

PVR, Inox Leisure in focus: Theatres, auditoriums will be reopened in Maharashtra from October 22, 2021

Shriram City Union Finance: Acacia II Partners LP & Others sold 3 lakh shares in the company via open market transaction on September 17, reducing shareholding to 3.01% from 3.46% earlier.

Indiabulls Housing Finance: BlackRock Inc sold 6,43,970 equity shares in the company via open market transaction, reducing shareholding to 3.56% from 3.7% earlier. Indiabulls Housing Finance has sold a portion of its stake in OakNorth Holdings for approximately Rs 251 crore.

Alankit: The company has entered into a project from Punjab National Bank related to request for proposal for engagement of corporate business correspondents for financial inclusion by providing banking services through Kiosks. The company will be entitled to receive substantial amount from Punjab National Bank.

Biocon: The US Food and Drug Administration has issued a Form 483 with a total of 6 observations across drug substance, drug product and devices facilities after completion of on-site pre-approval inspection at Biocon Biologics' Insulin manufacturing facility in Malaysia.

SJVN: The company has bagged the full quoted capacity of 1000 MW at a Viability Gap Funding (VGF) support of Rs 44.72 lakh per MW from Government of India, through Request for Proposal (RFP) floated by Indian Renewable Energy Development Agency Limited (IREDA). The tentative cost of construction and development of this project is Rs 5,500 crore.

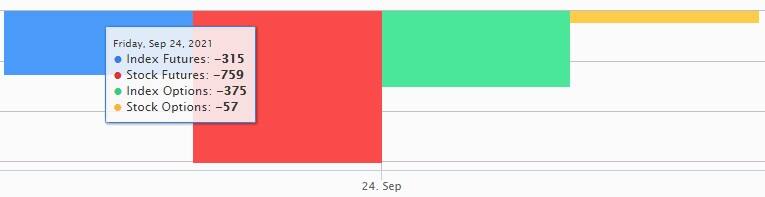

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net acquired shares worth Rs 442.49 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 515.85 crore in the Indian equity market on September 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Eight stocks - Canara Bank, Escorts, Indiabulls Housing Finance, Vodafone Idea, IRCTC, Punjab National Bank, SAIL and Zee Entertainment Enterprises - are under the F&O ban for September 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Monday: Top 15 things to know before Opening Bell - Moneycontrol.com

Read More

No comments:

Post a Comment