India’s top banks five years ago built the interoperable UPI railroads and enabled over 150 million people in the South Asian market to pay digitally. Scores of firms — including local firms Paytm, PhonePe, CRED and international giants Google and Facebook — in India today support the UPI infrastructure, which is now reporting 3 billion transactions each month.

Banks are now ready for their second act.

On Thursday, eight Indian banks announced that they are rolling out — or about to roll out — a system called Account Aggregator to enable consumers to consolidate all their financial data in one place. (Participants banks are HDFC, Kotak, ICICI, Axis, SBI, IndusInd, IDFC, and Federal. Four of them are rolling out the system on Thursday, others say they will roll out the new system soon.)

The objective of Account Aggregator (AA) is to aggregate all financial information of an individual, said M Rajeshwar Rao, Deputy Governor of India’s central bank — Reserve Bank of India — at a virtual event Thursday.

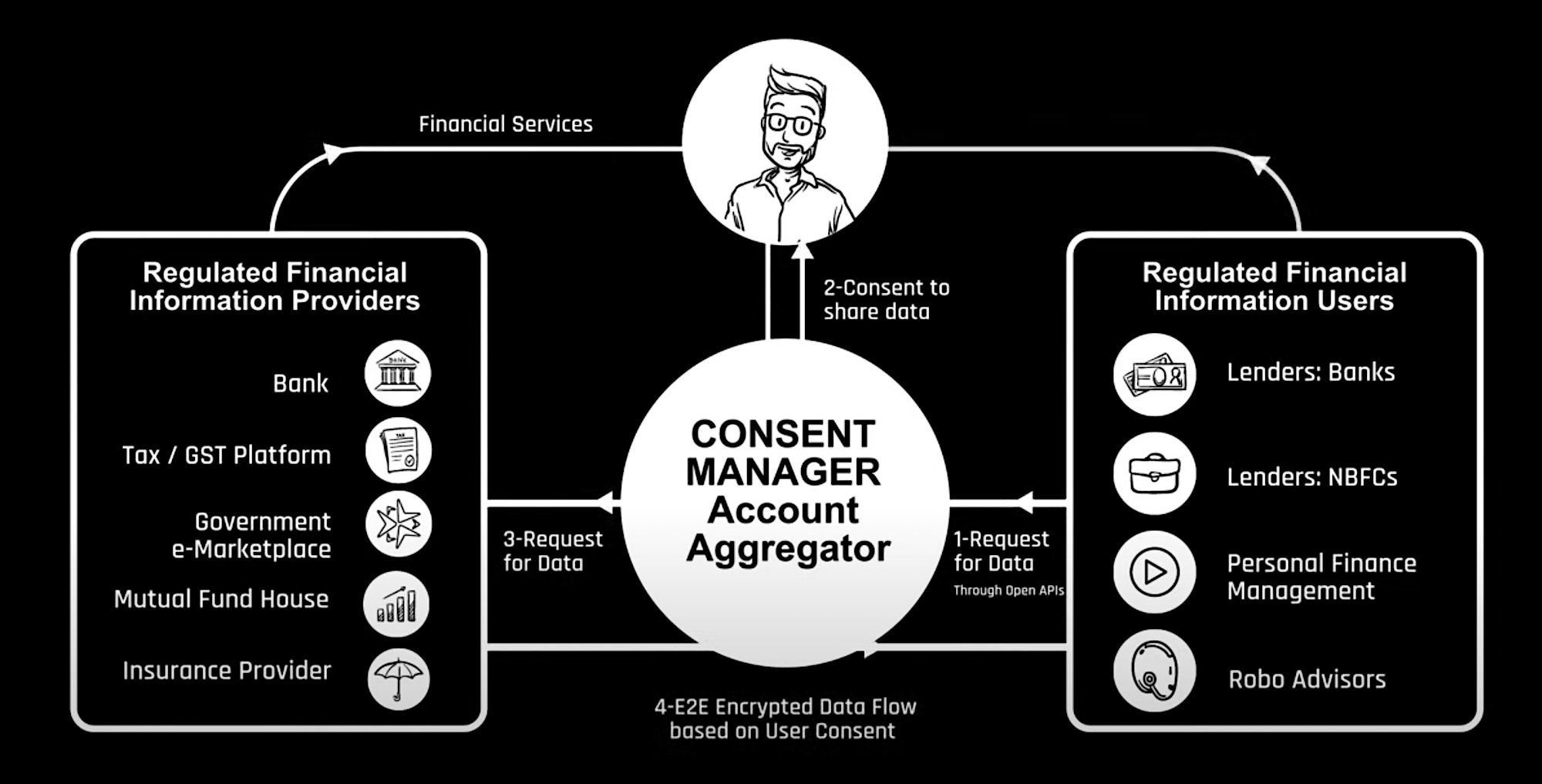

The new system makes it possible for banks, tax authorities, insurers, and other finance firms to aggregate data of customers — who have provided their consent — to get better understanding about their potential customers, make informed decisions and ensure smoother transactions.

Users who provide consent — and it only takes a few taps to do so — will be able to share their financial information from one Account Aggregator participant to another through a centralized API-based repository. Users get to decide for how long they wish their data to be shared with a particular Account Aggregator participant.

An illustration of how the AA system works.

Most countries globally already have privacy laws that recognize the rights of individuals. But even as individuals and businesses have the right to exercise their control over their data, the current system has made it difficult for consumers to operationalize how they provide consent.

“They face this difficult for two reasons,” explained Siddharth Tiwari, head of the Bank for International Settlements in Asia and Pacific. “Firstly, a service provider usually seeks consent to use and transfer data at time when consumers [are] agreeing to participate in an activity with the service provider. Since this consent is granted for a wide variety of possibilities, it is broad and sweeping in nature,” he said.

“Secondly, newly created data are often gathered and retained in proprietary silos and stored in various institutions in incompatible formats. Consumers can find it difficult to share their data as they have only limited options. […] Thus, service providers who are custodians of data effectively act as defacto owner of the data,” he said, adding that Account Aggregator is designed to potentially address these challenges. “A robust consent-based data sharing system has the potential for consumers derive value from their data while maintaining control.”

Account Aggregator is built in part to also help consumers and businesses access financial services such as loans. Existing credit bureaus in India have data of only a fraction of the nation’s 1.4 billion population, which makes it very difficult for most in the country to access working capital, explained Infosys chairman Nandan Nilekani, who’s been an adviser to the initiative, at the event Thursday.

Most of these individuals have made enough digital financial transactions and businesses have enough cashflow to show that would make them eligible for financial services, he said. “Digital footprints, when properly used, empowered by consumers using their own data, enables a huge amount of credit to small businesses. It can lead to the democratisation of credit.”

“Talks are on to onboard telecom operators as well,” he said, adding that the system has already achieved the sophistication that it could be extended to other industries.

“It’s an architecture that can now be applied to several additional industries,” he said, pointing to healthcare, fitness, testing labs as examples. “We can confidently say that there is no other country in the world that has built a robust infrastructure at this scale where its people can leverage their data. This approach is now getting global recognition.”

“For retail loan underwriting (“eligibility check”), rather than submitting previous 3 years bank statements, I can simply authenticate a data transfer via AA (and revoke the data transfer AFTER the loan is approved or sanctioned). For self-employed or freelance professionals, getting Term Insurance has always been difficult since they cannot prove their income – AA lets you provide an audit trail of past income to underwrite the Term Insurance application,” Rahul Mathur, founder and chief executive of insurance aggregator startup BimaPe, told TechCrunch.

The Account Aggregator system is also positioned to dramatically increase the addressable market for online insurers, lenders, and players in several other industries.

“This is a big step towards a connected financial ecosystem, and will be very significant in Fi’s journey to help working millennials get better with their money. With the successful demonstration of the framework today we are excited to have all our users experience the power and convenience of the AA integration once it’s rolled out to all users,” said Sumit Gwalani, co-founder of Fi.

India launches Account Aggregator to extend financial services to millions - TechCrunch

Read More

No comments:

Post a Comment