Representative Image

You don’t see a $4.7 billion all-cash acquisition every day. A funding round at that valuation, maybe. But, fintech PayU’s buyout of payment gateway BillDesk for $4.7 billion stands out for many reasons- its mega size is only one of them.

India’s second largest internet deal after Walmart’s acquisition of Flipkart in 2018 takes Prosus, the parent of Naspers and PayU’s investments in India to over $10 billion. With many acquisitions and large investments, Prosus today has more skin in India than even many large venture capitalists or private equity funds.

Whispers of this mega deal have been doing the rounds since a while. Moneycontrol reported deal talks on July 6. What made BillDesk’s founders put the well-established payments player on the block? And how will this pan out for Prosus, whose PayU already processes $25 billion of payments every year?

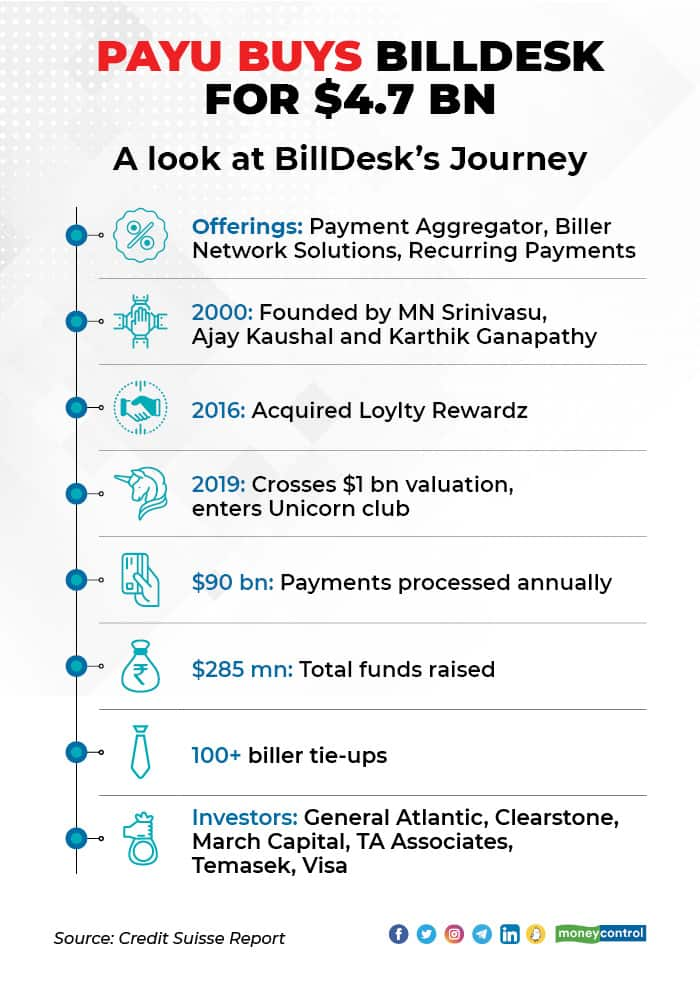

Founded in 2000 by MN Srinivasu, Ajay Kaushal and Karthik Ganapathy, BillDesk focuses on making, accepting and collecting payments. Besides facilitating over 170 payment methods as a payment aggregator, it provides biller network solutions through the Bharat Bill Payment System (BBPS) and enables collection of recurring payments.

While BillDesk has a stronghold in government and Banking, Financial Services and Insurance (BFSI) segments, PayU is the go-to payment gateway for an array of internet companies. BillDesk has a near monopoly in payment processing for government agencies- also lucrative because this is a steady source of income and forever growing, compared to ecommerce, travel or other industries which have seasonal peaks and troughs.

But no online payment player can stay large and relevant without integrating with the new economy, and BillDesk’s banking partnerships provide a new market for PayU, rather than overlapping with its business.

“PayU has been losing ground in the internet segment as new players are making in-roads in the space. Razorpay recently overtook PayU as the largest player in the internet ecosystem. Since then, they have been exploring ways to expand their offerings,” said a senior fintech executive, who requested anonymity.

Prosus said while announcing the deal that PayU India and BillDesk will handle four billion transactions a year combined- four times PayU’s current size in India. Both parties are betting on a growing market.

“This is a big bet for PayU. They are very bullish on the India market. Even if the share of online payment goes from 30 percent to 50 per cent in five years, it is a huge addition to transaction volumes,” said Mihir Gandhi, partner at consultancy firm PwC.

BillDesk handled payments worth $90 billion in FY21, and has tie-ups with over 100 billers. It also has a 50 percent market share in debit card reward points management in India.

BillDesk’s sheer size- it recorded profits of $37 million on a revenue of about $230 million- has given it a valuation of 20 times its revenue- unprecedented in the industry for most such acquisitions. Bankers and analysts had pegged BillDesk’s sale price at $2.5 billion.

But as is the case for most deals, the valuation is tightly linked to market conditions and timing.

The timing is perfect for a sale because the Indian fintech space continues to see enormous funding interest.We don’t know what the future holds, but the market right now is very hot,” the founder of a fintech company said, requesting anonymity.

“The valuation may seem high but Prosus may actually see it as a bargain because if BillDesk listed on the stock markets today, its price would be even higher. Having run a business for 20 years, the founders know what is the right timing,” this person added.

The deal marks PayU’s fourth Indian acquisition, after Citrus Pay in 2016, Wibmo in 2019 and PaySense in 2020- attempting to build a full fintech ecosystem in India.

“It is a really good deal for the founders and the ecosystem. Realistically, payments [space] is becoming a scale game. Payment volumes are exploding but revenue per transaction is declining. The winners in payments essentially need to build massive scale to garner revenues,” said Lizzie Chapman, Co-founder and Chief Executive Officer of ZestMoney, which deals with both PayU and BillDesk.

The acquisition also indicates the market consolidating into a few large, strong players, since it cannot be fragmented or sustainable endlessly. PwC’s Gandhi expects more consolidation of the space.

PayU India CEO Anirban Mukherjee said that the company will focus on payments, credit and financial services.

“We are trying to do three things in India. One, the acquisition makes us one of the leading players in digital payments. Then in credit, we have launched digital credit products like Buy Now Pay Later (BNPL), and we are extending credit to SMBs (Small and Medium Businesses). We also want to build a full fintech ecosystem to serve the financial needs of consumers and merchants,” he said on a call with reporters

To grow the fintech vertical the company will rely on a partnership-led model, while it focuses its organic growth efforts on payments and credit.

“India has been our core market the last few years. We want to address large structural needs in high growth markets. What we see is an opportunity for partnership, we don't have to build everything ourselves. We also are very excited to work with Indian partners we have invested in,” said Bob van Dijk, Group CEO of Prosus.Explained | PayU-BillDesk deal worth $4.7 billion: Who gains and how - Moneycontrol.com

Read More

No comments:

Post a Comment