The market continued to end at record closing high, though there was volatility throughout session on August 17, supported by FMCG, IT and select pharma stocks.

The BSE Sensex rose 209.69 points to 55,792.27, while the Nifty50 climbed 51.60 points to 16,614.60 and formed bullish candle on the daily charts as the closing was higher than opening levels.

"A reasonable positive candle was formed on a daily chart and the new high was formed at 16,628 levels. Formation of lower shadow signal buy on dips opportunity in the market. This is positive indication and it indicates an uptrend continuation pattern," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said, "The short term trend of Nifty continues to be positive. There is a possibility of further upside with rangebound action for short term. The next upside levels to be watched 16,800-16,900 levels in the next few sessions."

Immediate support is placed at 16,540 levels, he added.

The broader markets ended mixed as the Nifty Midcap 100 index was up 0.33 percent and Smallcap 100 index fell 0.25 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,530.47, followed by 16,446.33. If the index moves up, the key resistance levels to watch out for are 16,663.67 and 16,712.73.

Nifty Bank

The Nifty Bank fell 227.10 points to 35,867.40 on August 17. The important pivot level, which will act as crucial support for the index, is placed at 35,654.96, followed by 35,442.53. On the upside, key resistance levels are placed at 36,036.77 and 36,206.13 levels.

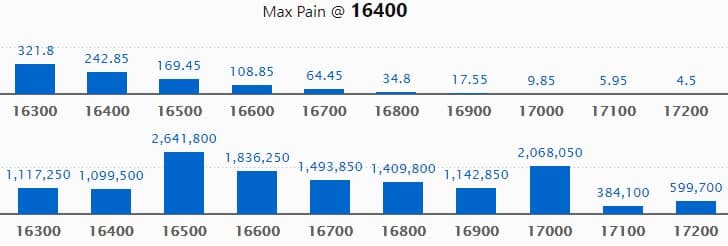

Call option data

Maximum Call open interest of 26.41 lakh contracts was seen at 16500 strike, which will act as a crucial resistance level in the August series.

This is followed by 17000 strike, which holds 20.68 lakh contracts, and 16600 strike, which has accumulated 18.36 lakh contracts.

Call writing was seen at 16600 strike, which added 5.14 lakh contracts, followed by 17000 strike, which added 3.26 lakh contracts and 16700 strike which added 3.01 lakh contracts.

Call unwinding was seen at 16400 strike, which shed 3.14 lakh contracts, followed by 16000 strike which shed 2.28 lakh contracts, and 16300 strike which shed 58,300 contracts.

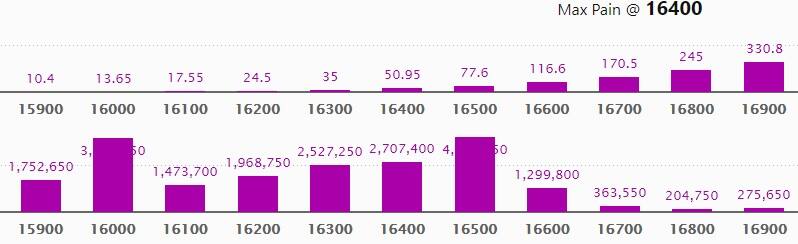

Put option data

Maximum Put open interest of 40.10 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the August series.

This is followed by 16000 strike, which holds 39.23 lakh contracts, and 16400 strike, which has accumulated 27.07 lakh contracts.

Put writing was seen at 16600 strike, which added 6.55 lakh contracts, followed by 16500 strike which added 5.14 lakh contracts, and 16400 strike which added 4.53 lakh contracts.

Put unwinding was seen at 15900 strike, which shed 19,800 contracts, followed by 17100 strike which shed 1,700 contracts.

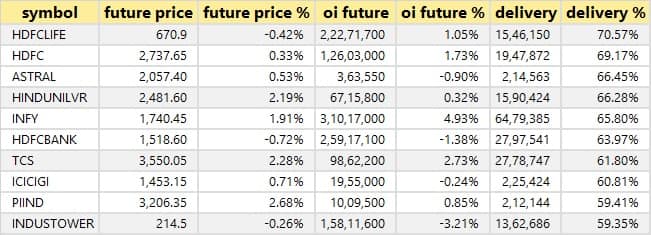

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

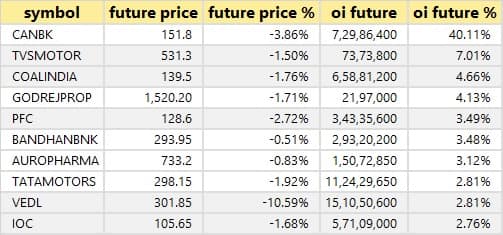

51 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

40 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

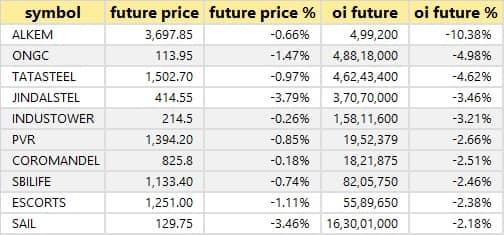

43 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

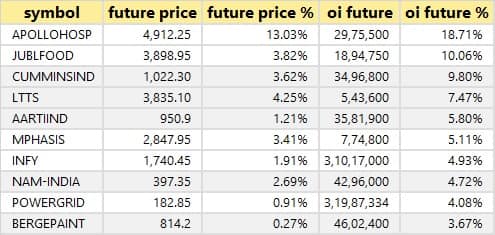

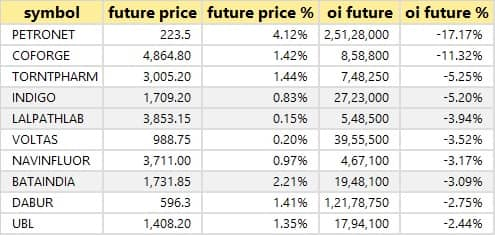

30 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

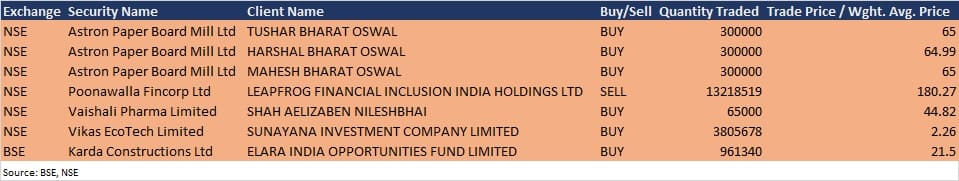

Bulk deals

Astron Paper Board Mill: Tushar Bharat Oswal and Mahesh Bharat Oswal acquired 3 lakh equity shares each in Astron Paper at Rs 65 per share, and Harshal Bharat Oswal bought 3 lakh shares at Rs 64.99 per share on the NSE, the bulk deals data showed.

Poonawalla Fincorp: Leapfrog Financial Inclusion India Holdings Ltd sold 1,32,18,519 equity shares in the company at Rs 180.27 per share on the NSE, the bulk deals data showed.

Vikas EcoTech: Sunayana Investment Company bought 38,05,678 equity shares in the company at Rs 2.26 per share on the NSE, the bulk deals data showed.

Karda Constructions: Elara India Opportunities Fund acquired 9,61,340 equity shares in the company at Rs 21.5 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Phillips Carbon Black: The company's officials will meet institutional investors on August 18, August 19, and August 20.

Lasa Supergenerics: The company's officials will meet analysts and investors on August 20, to discuss un-audited financial results.

Welspun India: The company's officials will meet Systematix Group on August 18.

Krishna Institute of Medical Sciences: The company's officials will meet analysts and investors on August 18.

MTAR Technologies: The company's officials will meet analysts on August 18.

Fine Organic Industries: The company's officials will meet investors and analysts on August 18.

Tube Investments of India: The company's officials will meet institutional investors on August 18.

India Glycols: The company's officials will meet the sell-side analysts in a group call on August 18.

RACL Geartech: The company's officials will meet White 0ak Capital Management on August 20.

Stocks in News

ISGEC Heavy Engineering: The company has bagged an order for two gas fired boilers from Naval Project, Indian Navy. The scope of work includes manufacturing of two 40 TPH Boilers on a turnkey basis.

Meghmani Organics (formerly known as Meghmani Organochem): The company to list equity shares on the bourses after demerger of agrochemical and pigment business.

IFCI: CARE downgraded credit rating on company's long term bank facilities to BB from BBB- and maintained Negative outlook.

Bharat Dynamics: The company and MBDA signed agreement to establish advanced short range air-to-air missile facility in India.

DCM Shriram Industries: The company has entered into an agreement with Zyrone Dynamics Havacilik Danismanlik Ve Ar-Ge San. Tic. A.S., a company incorporated under the laws of the Republic of Turkey. The said company is engaged in the manufacturing and marketing of UAVs of different types.

HCL Technologies: The company won five-year IT transformation deal with Wacker Chemie AG, German multinational chemical company, to establish a modernized digital workplace and improve its quality-of-service delivery.

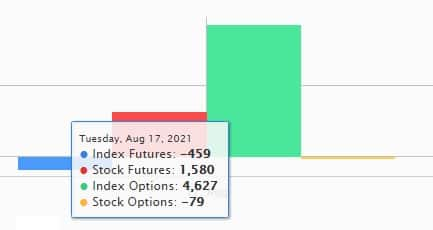

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 343.73 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 266.43 crore in the Indian equity market on August 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Seven stocks - Cadila Healthcare, Canara Bank, NALCO, Punjab National Bank, SAIL, Sun TV Network and Vedanta - are under the F&O ban for August 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.Trade setup for Wednesday: Top 15 things to know before Opening Bell - Moneycontrol.com

Read More

No comments:

Post a Comment