After hitting record-high levels intraday on August 18, the market settled marginally lower due to profit booking in sectors like banking and financials, metals, and select auto stocks.

The BSE Sensex settled at 55,629.49, down 162.78 while the Nifty50 slipped 45.80 points to 16,568.80, forming a bearish candle on the daily charts as the closing was lower than opening levels.

"A long negative candle was formed on the daily chart after opening higher, which indicated a formation of bearish counter attack type candle pattern. This market action suggests further consolidation or minor downward correction ahead," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

He said the market seems to have started tiring out at the new highs of 16,700. "But, there is no indication of any reversal pattern unfolding at the higher levels. Any decline from here down to the support of 16,400 (20-day EMA on a daily chart) could be a buy on dips opportunity in the near term," he said.

Nagaraj Shetti expects an upside bounce from the lows in the coming sessions. The upside target for Nifty remains at 16,900 levels, he said.

The broader markets ended mixed with the Nifty Midcap 100 index rising 0.29 percent and Smallcap 100 index falling 0.26 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,502.47, followed by 16,436.13. If the index moves up, the key resistance levels to watch out for are 16,668.47 and 16,768.13.

Nifty Bank

The Nifty Bank closed 312.90 points lower at 35,554.50 on August 18. The important pivot level, which will act as crucial support for the index, is placed at 35,241.37, followed by 34,928.23. On the upside, key resistance levels are placed at 36,058.27 and 36,562.03 levels.

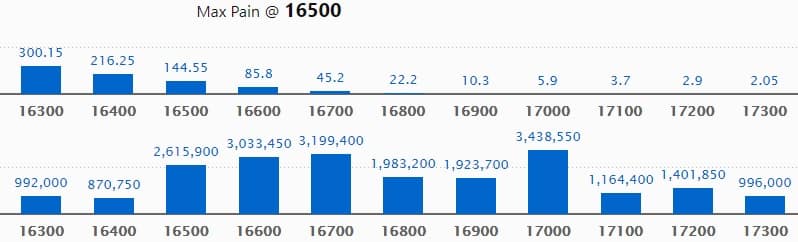

Call option data

Maximum Call open interest of 34.38 lakh contracts was seen at 17000 strike, which will act as a crucial resistance level in the August series.

This is followed by 16700 strike, which holds 31.99 lakh contracts, and 16600 strike, which has accumulated 30.33 lakh contracts.

Call writing was seen at 16700 strike, which added 17.05 lakh contracts, followed by 17000 strike, which added 13.70 lakh contracts and 16600 strike which added 11.97 lakh contracts.

Call unwinding was seen at 16400 strike, which shed 2.28 lakh contracts, followed by 16300 strike which shed 1.25 lakh contracts, and 16000 strike which shed 1.05 lakh contracts.

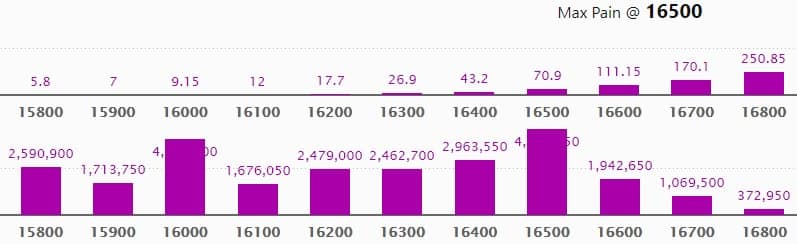

Put option data

Maximum Put open interest of 45.87 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the August series.

This is followed by 16000 strike, which holds 40.69 lakh contracts, and 16400 strike, which has accumulated 29.63 lakh contracts.

Put writing was seen at 16700 strike, which added 7.05 lakh contracts, followed by 16600 strike which added 6.42 lakh contracts, and 16500 strike which added 5.77 lakh contracts.

Put unwinding was seen at 16300 strike, which shed 64,550 contracts, followed by 15900 strike which shed 38,900 contracts and 17000 strike which shed 8,050 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

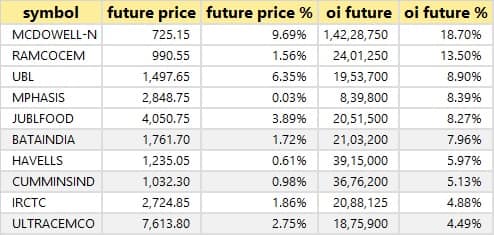

35 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

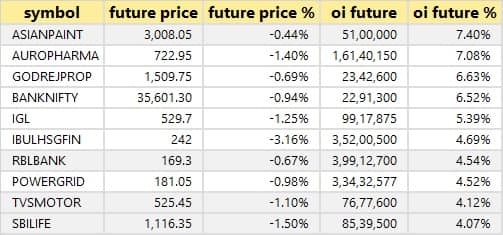

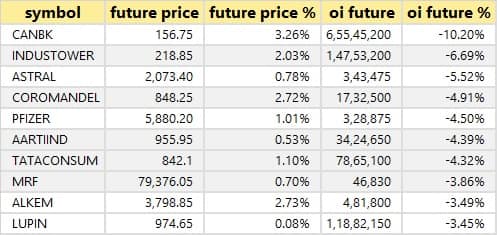

32 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

50 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

44 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

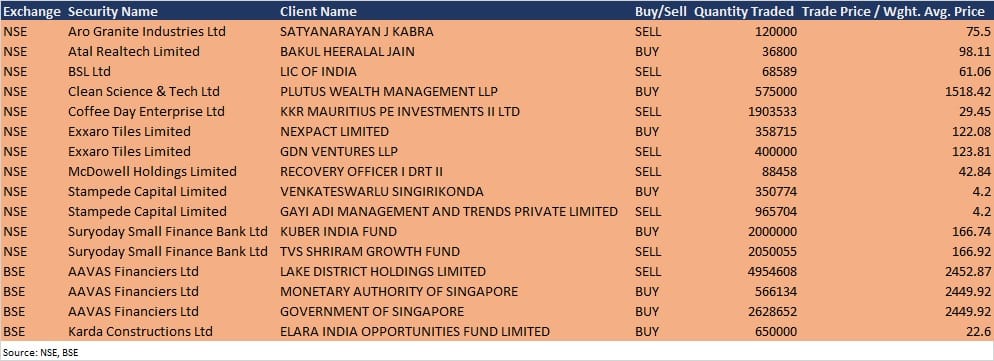

Bulk deals

BSL Ltd: LIC of India sold 68,589 equity shares in the company at Rs 61.06 per share on the NSE, the bulk deals data showed.

Clean Science & Technology: Plutus Wealth Management LLP acquired 5.75 lakh equity shares in the company at Rs 1,518.42 per share on the NSE, the bulk deals data showed.

Coffee Day Enterprises: KKR Mauritius PE Investments II sold 19,03,533 equity shares in the company at Rs 29.45 per share on the NSE, the bulk deals data showed.

McDowell Holdings: Recovery Officer I Debt Recovery Tribunal II sold 88,458 equity shares in the company at Rs 42.84 per share on the NSE, the bulk deals data showed.

Suryoday Small Finance Bank: Kuber India Fund acquired 20 lakh equity shares in the company at Rs 166.74 per share, whereas TVS Shriram Growth Fund sold 20,50,055 equity shares in the company at Rs 166.92 per share on the NSE, the bulk deals data showed.

AAVAS Financiers: Lake District Holdings sold 49,54,608 equity shares in the company at Rs 2,452.87 per share, whereas Monetary Authority of Singapore bought 5,66,134 equity shares and Government of Singapore acquired 26,28,652 equity shares in the company at Rs 2,449.92 per share on the BSE, the bulk deals data showed.

Karda Constructions: Elara India Opportunities Fund bought 6.5 lakh shares in the company at Rs 22.6 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Trident: The company's officials will meet investors in virtual conference organised by Prabhudas Lilladher on August 20.

Automotive Axles: The company's officials will meet analysts and investors on August 20, to discuss the financial performance.

IOL Chemicals & Pharmaceuticals: The company's officials will meet analysts and investors on August 20 to discuss the financial performance.

Mindtree: The company's officials will meet analysts and investors in Ambit's IT and Internet Conference, on August 20.

Meghmani Finechem: The company's officials will meet analysts and investors on August 20 to discuss financial results.

Bharat Forge: The company's officials will meet DSP MF on August 20, and Alchemy Capital on August 27.

Meghmani Organics: The company's officials will meet analysts and investors on August 20 to discuss financial results.

Sobha: The company's officials will meet analysts and investors in a meeting organised by Kotak Securities on August 24.

Castrol India: The company's officials will meet TATA AIG General Insurance on August 25.

Stocks in News

CarTrade Tech: The company will list its equity shares on August 20. The final price has been fixed at Rs 1,618 per share.

Tata Elxsi: The company collaborated with DStv Media Sales, to consult and collaboratively build a vision for DStv Media Sales (DMS) that addresses current challenges while also positioning DMS for future growth.

Prime Focus: Subsidiary DNEG in the United Kingdom said Novator Capital Advisers, LLP has invested $250 million in subsidiaries of Prime Focus, and personal holdings of its founder Namit Malhotra.

Kennametal India: The company reported consolidated profit at Rs 21.6 crore in Q1FY22 against loss of Rs 9.5 crore in Q1FY21, revenue jumped to Rs 211.9 crore from Rs 95.6 crore YoY.

CG Power and Industrial Solutions: The company approved a proposal for the voluntary winding up of CG Middle East FZE, a non-operating step-down subsidiary and CG International (Holdings) Singapore Pte. Ltd, a wholly-owned subsidiary of the company. The company also approved the closure of one of its non-operating subsidiaries, CG Power Solutions (PSOl), under the provisions of the Insolvency and Bankruptcy Code.

Zomato: The company acquired 9.16% shareholding in Grofers India for Rs 518.21 crore and 8.94% shareholding in Hands-on Trades for Rs 222.83 crore.

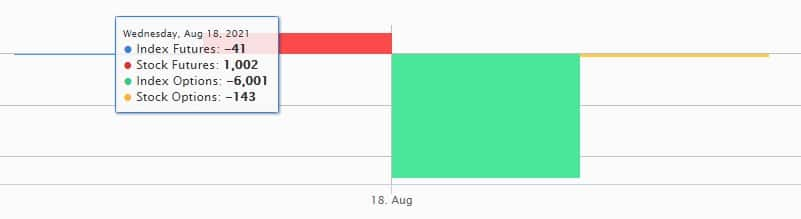

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 595.32 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 729.49 crore in the Indian equity market on August 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Seven stocks - Cadila Healthcare, Canara Bank, NALCO, Punjab National Bank, SAIL, Sun TV Network and Vedanta - are under the F&O ban for August 20. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.Trade setup for Friday: Top 15 things to know before Opening Bell - Moneycontrol.com

Read More

No comments:

Post a Comment