Indian markets continued to rise for the second straight week which ended August 13. Strong inflow of funds from both domestic and foreign investors amid favourable global cues and supportive macroeconomic helped benchmark claim new highs. Benchmark indices, Sensex and Nifty, touched their fresh record high levels of 55,487.79 and 16,543.60, on August 13.

On a weekly basis, BSE Sensex rose 1,159.57 points (2.13 percent) to close at 55,437.29, while the Nifty50 added 290.9 points (1.79 percent) to end at 16529.10 levels.

In the broader market, the BSE Midcap and Smallcap indices fell 1 percent and 1.7 percent, respectively. However, the BSE Largecap index rose 1.5 percent last week.

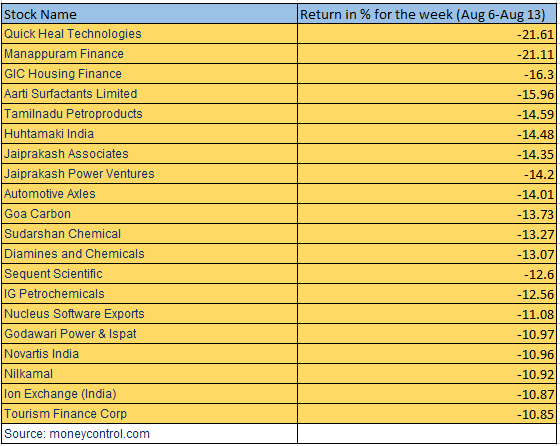

Among smallcaps, 31 stocks fell 10-21 percent. These include Quick Heal Technologies, Manappuram Finance, GIC Housing Finance, Aarti Surfactants, Tamilnadu Petroproducts, Huhtamaki India, Jaiprakash Associates, Jaiprakash Power Ventures, Automotive Axles and Goa Carbon.

On the other hand NELCO, Globus Spirits, Tejas Networks, Albert David, GTPL Hathway, Shriram City Union Finance and Vascon Engineers were among the 20 stocks which rose 10-33 percent.

“16800, which was our medium term target earlier, now becomes the short term target & the medium term target has been raised to 17500. The hourly & the daily momentum indicators are now showing overbought readings, so a minor pause cannot be ruled out. Nevertheless, the overall structure shows that the rally is far from over,” said Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas.

“Thus the short term traders are recommended to hold on to their long positions & ride the trend for higher targets. On the other hand, the near term support zone shifts higher to 16350-16400,” Ratnaparkhi added.

The BSE 500 index rose 0.7 percent led by the Shriram City Union Finance, Vakrangee, Max Healthcare Institute, VIP Industries, Allcargo Logistics and VRL Logistics.

“Markets are taking comfort from the upbeat global markets and supportive domestic cues amid the fear of a third COVID wave. However, we’re now seeing restricted participation and expect the same trend to continue, at least in the near future,’ said Ajit Mishra, VP - Research, Religare Broking.

“We thus advise continuing with the “buy on dips” approach but focus largely on index majors and select midcaps for long trades,” he added.

Where is Nifty50 headed?

“The market witnessed the continuation of the positive trend, after sustaining above the level of 16350. The market has breached an important resistance level of 16500. If the market sustains above the level of 16500, the market expects to gain momentum, leading to an upside projection till 16700-16750 level,” said Ashis Biswas, Head of Technical Research at CapitalVia Global Research.

“The momentum indicators like RSI and MACD to stay positive and market breadth to improve, further strengthening a short-term bullish outlook,” he added.

On Friday, Nifty formed a strong bullish candle on daily and weekly time frame and gave its highest daily close with the handsome gains of around 160 points.

“As far as levels are concerned, the sacrosanct support is placed at 16,200 – 16,170 before which 16,400 – 16,300 are to be considered as immediate levels. On the upside, it’s hard to project any level as we have entered an uncharted territory. Still, every 100 points rally from hereon should be treated as the upside range,” said Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel Broking.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Market hits fresh record high; mid & small-cap indices fall over 1% - Moneycontrol.com

Read More

No comments:

Post a Comment