Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed the continuation of positive trend, and an attempt to breach the level of 16350, after a reversal from the support level around 16200 yesterday. The market sustains above the level of 16350, the market expects to gain momentum, leading to an upside projection till 16450-16500 level. The momentum indicators like RSI and MACD indicating a positive outlook to continue.

Market Close: Benchmark indices ended near the day's high level supported by the IT and PSU Banking names.

At close, the Sensex was up 318.05 points or 0.58% at 54843.98, and the Nifty was up 82.10 points or 0.50% at 16364.40. About 2314 shares have advanced, 816 shares declined, and 113 shares are unchanged.

Power Grid Corp, Tech Mahindra, Tata Motors, HCL Technologies and L&T were among major gainers on the Nifty, while losers included Eicher Motors, Grasim Industries, ONGC, Dr Reddy’s Labs and IndusInd Bank.

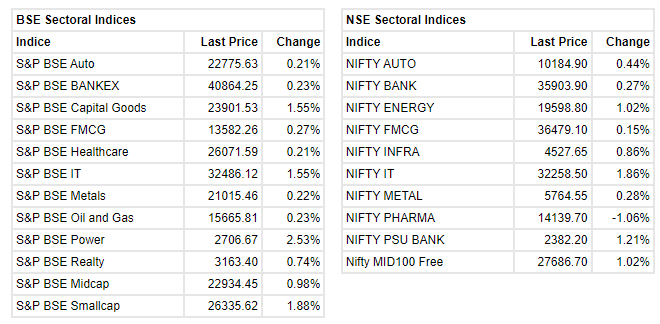

Except pharma, all other sectoral indices ended in the green with IT, power, PSU bank, realty and capital goods indices rose 1-2.5 percent. BSE Midcap and Smallcap indices added 1-2 percent.

Amarjeet Maurya - AVP - Mid Caps, Angel Broking:

During the 1QFY22, Bharat Forge Ltd (BFL) reported consolidated revenue of ~ Rs 2108 crore (up ~ 83% YoY) mainly due to healthy recovery in sales. On the consolidated EBITDA front, the company has reported profit of Rs 450 crore against loss of Rs 14 crore in 1QFY21 due to better operating leverage.

On the bottom-line front, the company has reported profit of Rs 153 crore against loss of Rs 127 crore due to higher sales and better operating performance.

Going forward, we expect BFL to report strong top-line & bottom-line growth on the back of demand outlook visibility and expect margin expansion on back of higher growth in the defence sector and sustained recovery in the auto space. We are positive on the stock with a buy rating.

Chemplast Sanmar IPO fully subscribed

The initial public offering (IPO) of Chemplast Sanmar, a specialty chemicals manufacturer, has been subscribed 1.84 times on August 12, the final day of bidding.

The offer received bids for 7.35 crore equity shares against an IPO size of 3.99 crore shares, the subscription data available on exchanges showed.

The portion set aside for qualified institutional buyers was subscribed 2.56 times and that of non-institutional investors saw 23 percent subscription.

Aptus Value Housing Finance IPO:

The public offer of retail-focussed housing finance company Aptus Value Housing Finance India is subscribed 10.41 times, garnering bids for 57.38 crore equity shares against IPO size of 5.51 crore equity shares on August 12, the final day of bidding, the subscription data available on exchanges showed.

The portion reserved for qualified institutional buyers witnessed 20.61 times subscription and that of non-institutional investors got subscribed 18.48 times.

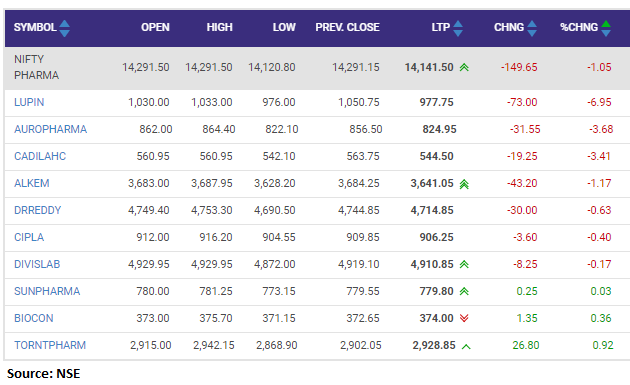

Nifty pharma index fell 1 percent dragged by the Lupin, Aurobindo Pharma, Cadila Healthcare:

Market at 3 PM

Benchmark indices were trading near the day's high level in the final hour of the trading.

The Sensex was up 324.68 points or 0.60% at 54850.61, and the Nifty was up 84.70 points or 0.52% at 16367. About 2189 shares have advanced, 769 shares declined, and 88 shares are unchanged.

IRCTC share price touches 52-week high:

Indian Railway Catering & Tourism Corp (IRCTC) share price touched a 52-week high of Rs 2,727.95, rising 6 percent on August 12 after company announced stock split and better numbers for the quarter ended June 2021.

"... in its board meeting recommended the proposal for sub-division of 1 equity share of face value of Rs 10 each into 5 equity shares of face value of Rs 2 each, subject to the approval of Ministry of Railways, shareholders and other approvals as may be required," compnay said in the release.

The company has reported a net profit of Rs 82.52 crore in the quarter ended June 2021 against loss of Rs 24.6 crore, while revenue was up 85.4% at Rs 243.36 crore versus Rs 131.33 crore.

Mid, Smallcaps Trip On BSE Circular, What Should Be Your Strategy Now?

Fundamentals, earnings growth and superior financial performance in Q1FY22 are some of the factors that can be looked into, say experts

BPCL Q1 results:

The company has reported net profit at Rs 1,501.7 crore versus Rs 11,940.1 crore and revenue was down 7.8% at Rs 70,922 crore versus Rs 76,882.3 crore, QoQ.

Bharat Petroleum Corporation was quoting at Rs 445.70, down Rs 4.20, or 0.93 percent on the BSE.

Mazagon Dock Shipbuilders Q1 earnings:

The company has reported net profit of Rs 101.6 crore in Q1FY22 against Rs 14 crore in Q1FY21. Its revenue was up at Rs 1,214.2 crore versus Rs 383.9 crore.

Mazagon Dock Shipbuilders was quoting at Rs 255.50, up Rs 15.95, or 6.66 percent on the BSE.

Closing Bell: Nifty ends above 16,300, Sensex gains 300 pts led by IT, PSU banks - Moneycontrol.com

Read More

No comments:

Post a Comment