Follow our LIVE blog for the latest updates on the RBI Monetary Policy 2021

Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

Two features of the market rally this year stand out: One, the rally has been steady with surprising lack of volatility; two, the broader market has been outperforming significantly. While the Nifty is up 12.22% YTD the Nifty Mid & Small-cap indices are up by 26.48% & 33.20% YTD respectively.

The spectacular performance of many mid-small-cap firms in Q4 FY21 and positive commentaries by managements have created lot of interest in these segments. Active retail participation in the broader market also is a significant factor contributing to the exuberance. A disturbing aspect in this broader market rally is the retail investors buying low-grade small-cap stocks driven by the FOMO (Fear Of Missing Out) factor. Investors have to exercise caution.

Today's monetary policy announcement is unlikely to impact markets since it is likely to keep repo rate unchanged while continuing with the accommodative stance. However, some unconventional policy initiatives can be expected.

Market moving data is likely to come from the US job numbers expected today. US jobs data has implications for inflation, bond yields, Fed's likely policy moves and hence for financial markets globally.

RailTel Corporation bags order of Rs 119.7 crore:

RailTel Corporation of India has received the work order of total amount of Rs 119.72 crore (Including GST) from M/s. Bharat Coking Coal Limited (BCCL), for Implementation of MPLS-VPN services alongwith miscellaneous services at 340 locations of BCCL for the period of 60 months (5 years).

Railtel Corporation of India was quoting at Rs 132.20, up Rs 1.45, or 1.11 percent on the BSE.

SEBI raises foreign investment limit for mutual funds to $1 billion

With international diversification getting more recognition, and investor flows moving into such mutual fund (MF) schemes, the market regulator Securities and Exchange Board of India (SEBI) has now increased the overseas investment limit to $1 billion.

“Inflows into international schemes have increased quite a bit. Even when the limits were increased last year, some fund houses were apparently close to the enhanced limits,” says Rajeev Thakkar, chief investment officer, at PPFAS MF.

Glenmark Pharma gets USFDA nod for Theophylline extended-release tablets

Glenmark Pharmaceuticals has received final approval by the United States Food & Drug Administration (USFDA) for Theophylline ExtendedRelease Tablets, 300 mg and 450 mg, bioequivalent and therapeutically equivalent to the reference listed drug, Theophylline Extended-Release Tablets, 300 mg and 450 mg, of Alembic Pharmaceuticals Limited.

Glenmark Pharma was quoting at Rs 617.00, up Rs 0.75, or 0.12 percent on the BSE.

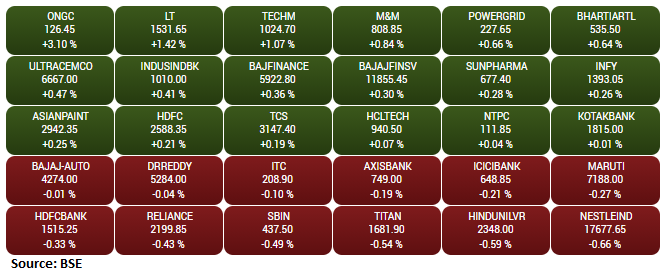

Gainers and Losers on the BSE Sensex:

Market Opens: Indian indices opened flat on June 4 ahead of the RBI monetary policy outcome.

At 09:16 IST, the Sensex was up 5.01 points or 0.01% at 52237.44, and the Nifty was up 0.90 points or 0.01% at 15691.30. About 1242 shares have advanced, 335 shares declined, and 69 shares are unchanged.

Results on June 4

Punjab National Bank, Bank of India, Bharat Forge, MOIL, Ambalal Sarabhai Enterprises, Asahi Songwon Colors, Balkrishna Paper Mills, CHD Chemicals, Foods & Inns, Gufic Biosciences, Hotel Rugby, IOL Chemicals & Pharmaceuticals, Jai Corp, Jigar Cables, Jubilant Pharmova, Keltech Energies, Kranti Industries, NIIT, Paisalo Digital, Pennar Industries, Simbhaoli Sugars, and Varroc Engineering.

ICICI Direct:

Indian markets are likely to open flat and remain at record highs on the back of mixed global cues as optimism surrounding decline in the Covid-19 cases is negated by the concern related to the changes in the US monetary policy. US markets ended lower on the back of release of better-than-expected macroeconomic data and concerns regarding monetary policy outlook.

Market at pre-open: Benchmark indices are trading higher in the pre-opening session ahead of RBI policy outcome.

At 09:02 IST, the Sensex was up 127.66 points or 0.24% at 52360.09, and the Nifty was up 52.30 points or 0.33% at 15742.70.

Market LIVE Updates: Indices open flat ahead of RBI Policy outcome; ONGC top gainer - Moneycontrol.com

Read More

No comments:

Post a Comment