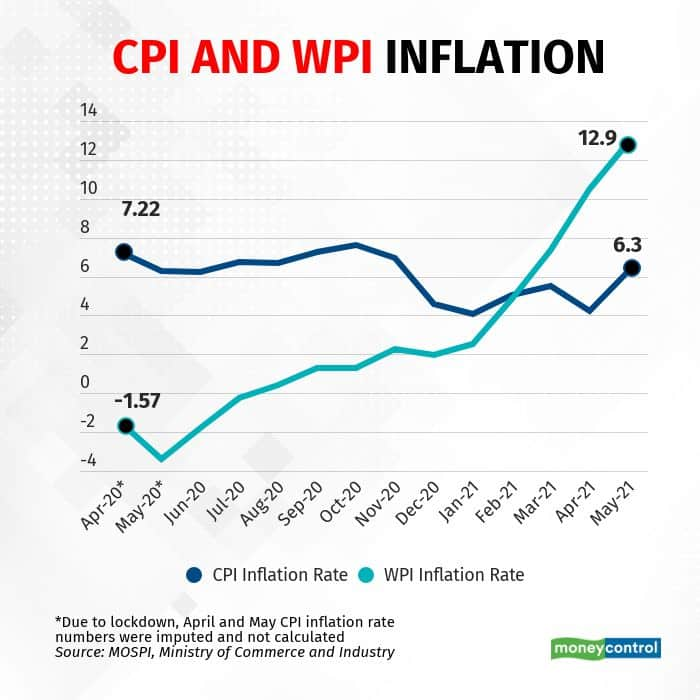

On June 14, the official data for wholesale and retail inflation were released. And both figures will cause some concern to the policymakers in the government and the Reserve Bank of India.

Wholesale Price Index-based inflation (WPI) touched a record 12.94 percent in May, as the constant rise in the cost of fuel, including petrol, LPG and high-speed diesel percolated down into the economy and a low base effect pushed up figures.

Meanwhile, Consumer Price Index-based inflation (CPI) reached its highest levels in six months, at 6.30 percent, much higher than April's 4.23 percent, and outside the Monetary Policy Committee's inflation targeting range of 4 (+/-2) percent for the first time since November 2020.

At a time when the economy is still reeling from the effects of a deadly wave of COVID-19, income levels have dropped and regional lockdowns have contributed to unemployment, a rise in inflation is the last thing the government wants to deal with.

What led to the rise in WPI inflation

WPI inflation has been on a continuous uptick from December 2020 onwards. It had already spiked in the previous month of April when it reached 10.94 percent, up from March's 7.89 percent, and February's 4.83 per cent. The pace of inflation has now accelerated for the fifth month in a row.

Fuel, power and non-food primary articles have a significant weightage in WPI inflation, almost 25 percent, while manufactured products have a 64 percent weightage. With a rise in global commodity prices, including that of oil, the transportation cost of the manufactured products have also increased, thus adding to wholesale inflation.

The month of May saw fuel inflation shooting up by 37 percent, almost double of April's 21 percent. According to the WPI, after reducing for 11 straight months, overall fuel prices had risen by just 2 percent in February. But since then it has escalated quickly.

The continued rise in global crude oil prices, a weaker rupee and the upward revision in domestic fuel prices remain risk factors for wholesale inflation in the upcoming months.

What’s more expensive for you?

It is CPI inflation which pinches the pocket of the average citizen. As per the data by National Statistical Office, while vegetable prices fell nearly two percent in May 2021 compared to the same period last year, inflation for fruits shot up nearly 12 percent. Inflation for eggs rose 15 percent, and oil and fats nearly 31 percent.

Inflation for pulses and products rose 9.4 percent, while that of non-alcoholic beverages rose 15 percent. The rise was steep even for some non-food items, with fuel and light registering an inflation of 11.6 per cent, and transport and communication at 12.4 percent.

Data showed that clothing and footwear got more expensive in May, rising 5.3 percent and 5.7 percent respectively. And in a month where there were local restrictions, as compared to a nationwide lockdown in the same period last year, personal care products rose 8 per cent, while recreation and amusement rose 6.3 per cent.

Going ahead, what does this mean?

In any given year, the rise in retail inflation would have led to calls for a rate hike by the Monetary Policy Committee. But when an imperative to push growth outweighs other considerations, analysts are unanimous in saying that the MPC will maintain the status quo.

Madan Sabvanis, Chief Economist with Care Ratings, said that headline inflation in the coming months could remain elevated despite a high base effect and the relaxation of lockdown restrictions by most of the states which could ease supply concerns.

“Seasonal factor would be pushing up price of vegetables and could lead to higher inflation. Higher prices for pulses and edible oil are likely to sustain for the next couple of months. Global commodity prices have been firmed up recently and this could have percolate from the wholesale basket to the retail basket,” Sabnavis said.

"We believe the MPC will demonstrate a high tolerance even if the average CPI inflation ranges between 5 percent and 6 percent in FY22, given the uncertainties regarding the growth outlook. Therefore, we continue to expect a status quo on the repo rate and a continuation of the accommodative stance through 2021," said Aditi Nayar, Chief Economist with ICRA Ltd.

This view was echoed by Sunil Sinha, Principal Economist with India Ratings, who said that given the growth inflation dynamics, the RBI may not be in a hurry to tinker with either the policy rate or its accommodative policy stance.

Sabnavis said that though record WPI numbers do not have a bearing on the MPC’s policy action, the unexpected spike in retail inflation does add to the uncertainty in the forthcoming monetary policy announcement.

“Though the RBI has been upright in giving higher weightage to growth over inflation, one may have to wait for the June 2021 retail inflation number to assess the RBI’s next policy action. CARE Ratings expects retail inflation to range between 5 percent and 5.5 percent with an upside bias in FY22,” he said.Explained | The rise in retail and wholesale inflation: Why it is a matter of concern - Moneycontrol.com

Read More

No comments:

Post a Comment