Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

India Ratings cuts GDP growth forecast to 9.6 percent for FY22

India Ratings & Research on June 25 cut its forecast for India's gross domestic product (GDP) growth in 2021-22 to 9.6 percent from 10.1 percent earlier due to the outbreak of the second wave of COVID-19.

Adding, the growth in India's GDP may further fall to 9.1 percent if the country's vaccination drive is delayed by around three months and the country's entire adult population is not vaccinated by the end of the year.

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some recovery from the support of 15800. Market suggests, trading above 15800 is positive from a short-term perspective. If the market breached the resistance zone of 15900-15920 and sustain above these resistance zone, the market expects to gain momentum, leading to an upside projection till 16100-16200 level. The momentum indicators like RSI, MACD to further strengthen in favor of a positive outlook.

Rupee Close:

Indian rupee ended flat at 74.18 per dollar, amid buying saw in the domestic equity market.

It opened flat at 74.14 per dollar against Thursday's close of 74.16 and traded in the range of 74.13-74.24.

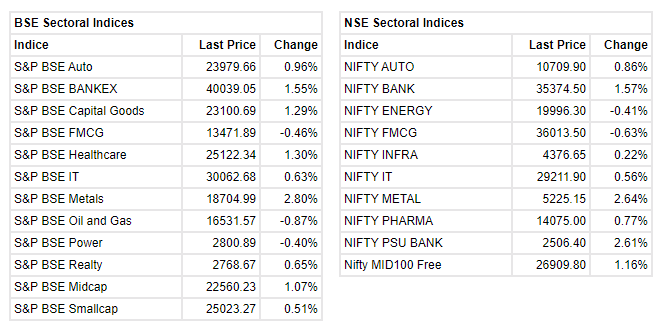

Market Close: Benchmark indices ended higher for the second consecutive day on June 25 supported by metal and financials.

The Sensex was up 226.04 points or 0.43% at 52925.04, and the Nifty was up 69.90 points or 0.44% at 15860.40. About 1737 shares have advanced, 1393 shares declined, and 142 shares are unchanged.

Tata Steel, Axis Bank, SBI, ICICI Bank and Hindalco Industries were among major gainers on the Nifty, while top losers included Reliance Industries, Titan Company, NTPC, HUL and Asian Paints.

On the sectoral front, Nifty Bank, metal and PSU Bank indices added 1-2.5 percent, while BSE midcap index added 1 percent.

Hemant Kanawala, Head – Equity, Kotak Mahindra Life Insurance:

Last 2 months have been very challenging for India due to wave 2 of covid infection and lockdowns announced by state governments to control the spread of infection. On the positive note, Covid infection in India in terms of new cases, active cases and mortality has come down sharply over last 1 month. There has been dramatic improvement in the vaccination rate lately and till date, India has administered 30 crore doses of covid vaccination.

As the pace of vaccination improves over the next quarter, there is an increased probability of complete opening up of the economy into the festive season. Another positive news for the economy is the prediction of normal monsoon by Indian Met department, which should greatly help rural India where the impact of wave 2 of covid infection has been more than wave 1. Increase in vaccination rate and normal monsoon should support strong economic growth in 2nd half of FY22.

Nifty 50 is trading at more than 20 times 1 year forward earnings, which is close to historic high and supported by low interest rates in India and globally. Last week, US Fed has started discussing path for reducing liquidity support, which it has been providing for last 1 year to stimulate growth. As and when they announce their roadmap, it can bring volatility in risk assets including emerging markets and India.

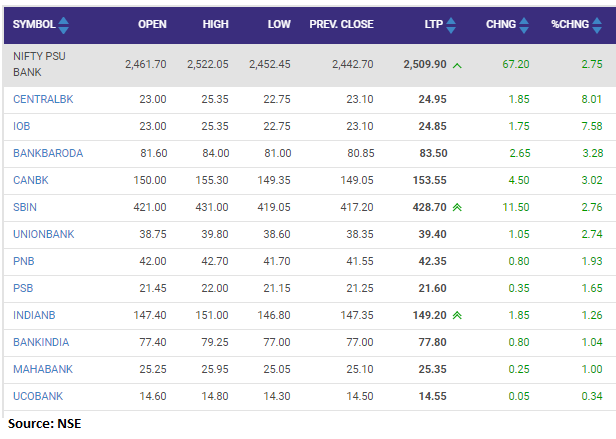

Nifty PSU Bank index added nearly 3 percent led by the Central Bank of India, IOB, Bank of Baroda

Abhishek Bansal, Founder Chairman, Abans Group

Silver is currently trading near $26.285, sharply high from Monday’s low of $25.580. Weakness in the US dollar index is likely to support precious metals prices. The dollar index is currently trading near 91.74 which is sharply lower from a high of 92.395 registered on June 18.

However, weaker than expected US economic data is likely to keep a cap on Silver prices.

Silver prices are likely to find immediate support near $25.67 and $25.10 while immediate resistance is seen around 20 days EMA at $26.87 and 50 days EMA at $27.017

Parag Milk Foods Q4:

The company has posted net loss at Rs 9.6 crore in Q4FY21 versus Rs 10.1 crore in a year ago period. Revenue was down 18.8% at Rs 434.3 crore versus Rs 535.2 crore.

Parag Milk Foods was quoting at Rs 135.75, down Rs 1.80, or 1.31 percent on the BSE.

Market at 3 PM

Benchmark indices extended the gains in the final hour of the trading with Nifty around 15850.

The Sensex was up 254.41 points or 0.48% at 52953.41, and the Nifty was up 76.00 points or 0.48% at 15866.50. About 1644 shares have advanced, 1284 shares declined, and 108 shares are unchanged

Tata Steel, Axis Bank, SBI, ICICI Bank and Hindalco Industries were among major gainers on the Nifty, while top losers included Reliance Industries, Titan Company, NTPC, HUL and Asian Paints.

Rupee Updates:

Indian rupee is trading marginally lower at 74.21 per dollar, amid buying seen in the domestic equity market.

It opened flat at 74.14 per dollar against Thursday's close of 74.16.

Closing Bell: Nifty ends above 15,850, Sensex gains 226 pts led by metal, financials - Moneycontrol.com

Read More

No comments:

Post a Comment