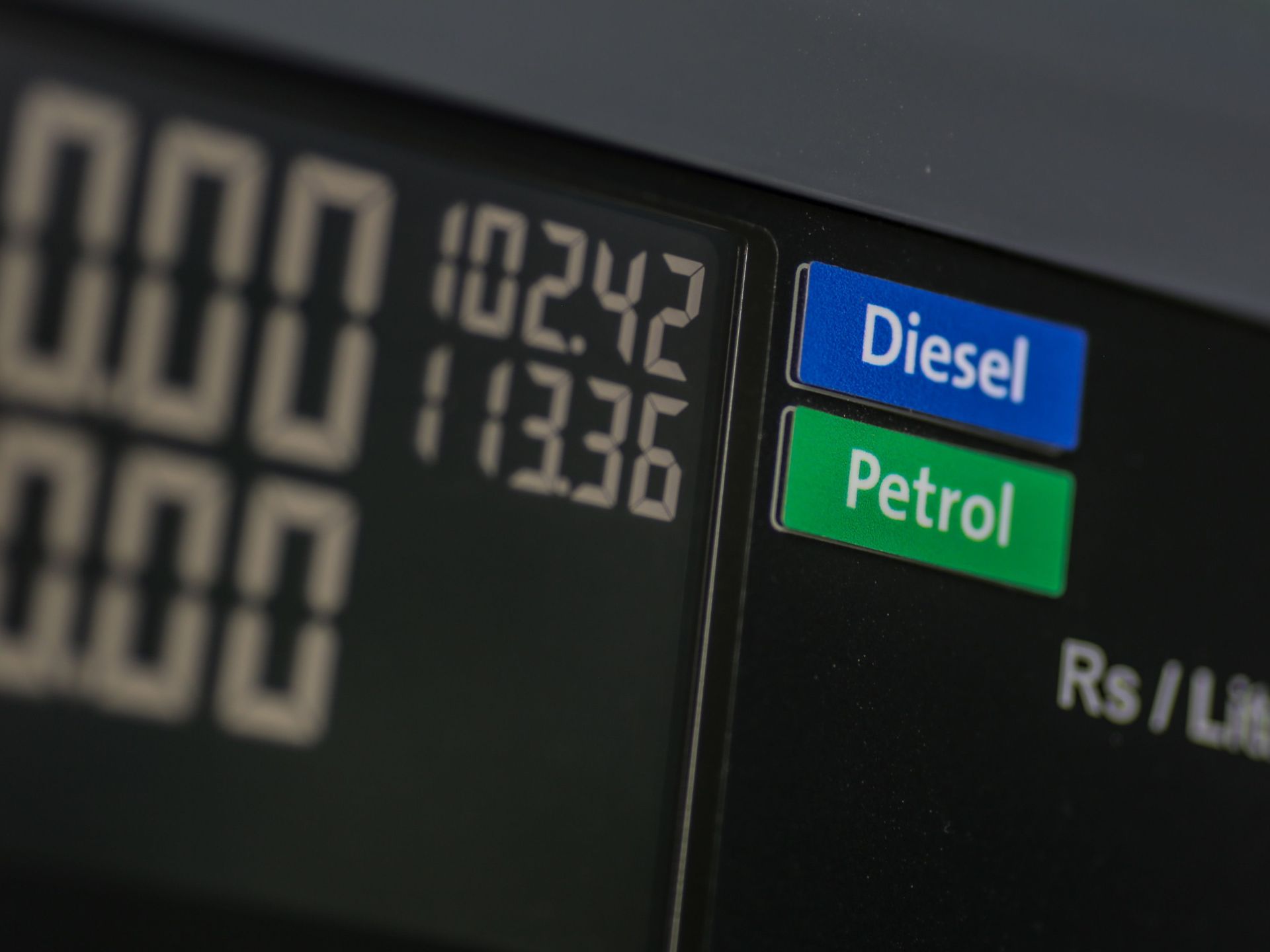

Indian markets gained for the second session led by gains in Reliance Industries Ltd and banking and IT stocks. Investors are keenly awaiting the Reserve Bank of India's (RBI) bimonthly monetary policy. At 14.15 pm, the benchmark Sensex was 1.73 percent or 1003 points higher at 58,963 while the Nifty gained 1.65 percent or 281 points to 17,362 points. The banking crisis in the US and Europe led to a decline in global and Indian equities. Additionally, Indian markets have been adversely affected by continued selling by foreign investors and potential weak earnings as a result of adverse weather conditions, including the possibility of an El Nino event impacting the southwest monsoon, which could have a significant impact on inflation. Here's a list of key factors behind the today's market rally RBI policy meeting next week: Attention is focused on the RBI's policy meeting next week, where many economists predict a 25-basis point rate hike. Kotak Institutional Equities suggests that the central bank will adopt a more balanced approach to managing inflation, considering the challenges posed by global financial markets and various macro factors. According to the brokerage, prematurely pausing current policies could create confusion regarding inflation pressures and financial sector risks. The RBI is scheduled to review the rates on April 6. As per a Moneycontrol survey, 20 out of 36 respondents anticipate that the central bank will continue with its withdrawal of an accommodative stance, while the remaining 16 predict a shift to a neutral stance. Improvement in current account deficit: Going by the latest reports, many economists expect India's current account to improve in fiscal year 2024 led by an incrementally narrowing trade deficit amid receding commodity prices, especially that of oil. "Also, solid services trade surplus will strongly offset CAD (current account deficit), which will now likely print sub $100 billion in FY23E ($90 billion vs our earlier forecast of $107 billion)... For FY24E, lower prices of oil (avg. estimate: $90/bbl) and commodities, along with easing domestic/global demand, may lead to CAD/GDP lowering to ~2.2% vs our earlier est. of 2.6% (USD82bn vs USD97bn earlier)", Emkay Research said in its latest report. RBI Bulletin: The March edition of the RBI Bulletin gave an optimistic outlook on growth, suggesting that the current estimates for India's GDP growth in FY24 of between 6 and 6.5 percent may be exceeded. According to the report, India is expected to maintain the pace of expansion achieved in 2022-23, indicating that the country's growth trajectory is unlikely to slow down. US Fed: The US economy seems to be worsening, as suggested by the latest GDP figures with the print coming in at 2.6 percent for the final quarter of last year, slightly below the 2.7 percent predicted by analysts. Due to the overhang of the banking crisis, financial specialists predict that the credit markets in the US will remain under pressure, and there is a risk of the economy slipping into a recession. In light of this, the US Federal Reserve may decide against raising interest rates further and may even introduce multiple rate cuts later in 2023. Investors are now closely monitoring the release of core personal consumption expenditure data, set to be released later on Friday. These data releases are crucial in providing investors with insight into the Federal Reserve's probable future actions.

Sensex, Nifty climb 1.7% amid firm global cues: Key factors driving the rally - Moneycontrol

Read More

COMMents