January 31, 2023 / 03:42 PM IST

Reliance Consumer Products enters into strategic partnership with Sri Lanka based Maliban Biscuit Manufactories

Reliance Consumer Products Limited (RCPL), the FMCG arm and a wholly owned subsidiary of Reliance Retail Ventures Limited (RRVL), announced a strategic partnership with Sri Lanka headquartered Maliban Biscuit Manufactories (Private) Limited (Maliban).

January 31, 2023 / 03:32 PM IST

Rupee Close:

Indian rupee closed 42 paise lower at 81.92 per dollar against previous close of 81.50.

January 31, 2023 / 03:30 PM IST

Market Close: Benchmark indices ended on positive note in yet another volatile session on January 31.

At Close, the Sensex was up 49.49 points or 0.08% at 59,549.90, and the Nifty was up 13.20 points or 0.07% at 17,662.20. About 2368 shares have advanced, 1026 shares declined, and 131 shares are unchanged.

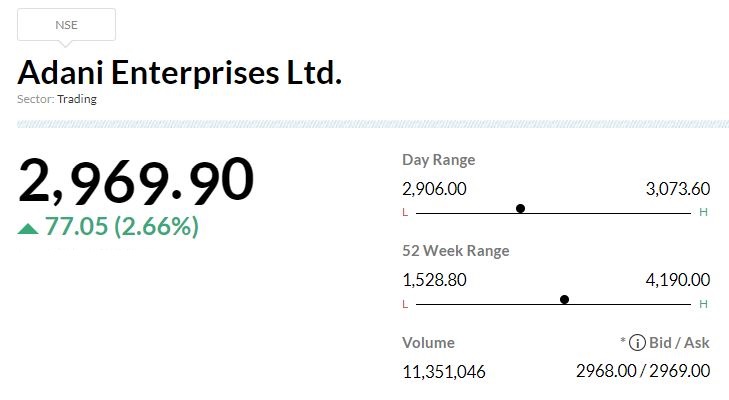

M&M, SBI, UltraTech Cement, Adani Ports and Adani Enterprises were among the top gainers on the Nifty, while losers were Bajaj Finance, TCS, Tech Mahindra, Britannia industries and Sun Pharma.

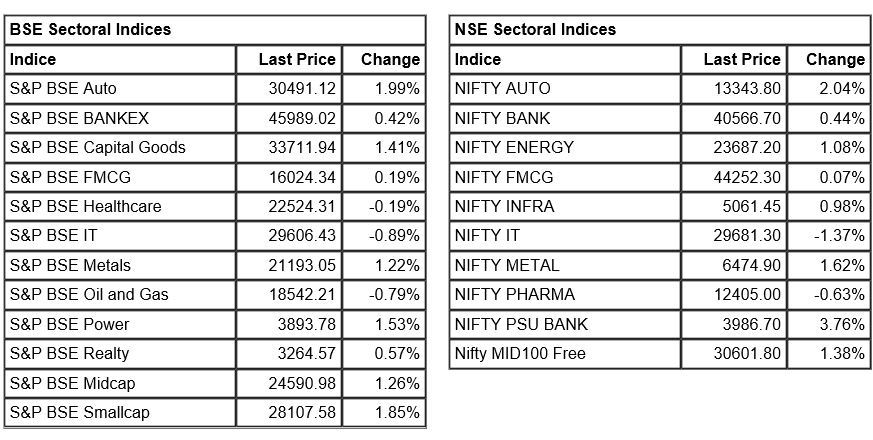

Except IT, pharma and oil & gas, all other sectoral indices are trading in the green.

The BSE midcap index gained 1.4 percent and the smallcap index rose 2.2 percent.

January 31, 2023 / 03:25 PM IST

Oil falls on rate hike worries, Russian export flows

Oil prices fell on Tuesday as the prospect of further interest rate increases and ample Russian crude flows outweighed demand recovery expectations from China.

March Brent crude futures fell by $1.01, or 1.19%, to $83.89 per barrel by 0920 GMT. The March contract expires on Tuesday and the more heavily traded April contract fell by 90 cents, or 1.07%, to $83.60.

January 31, 2023 / 03:24 PM IST

Adani Enterprises FPO fully subscribed on Final day

The Follow-On Public Offering (FPO) of Adani Enterprises had got bids for 46.27 million shares against an offer size of 45.5 million shares, representing a 102 percent subscription, in the afternoon of January 31, the third and final day of bidding.

This excludes the anchor portion that was fully subscribed.

Retail investors have taken a backseat as the stock price slid below the FPO price band, bidding for only 11 percent of the shares set aside for them.

Qualified institutional buyers (QIB) are at the forefront. They have bid for 12.44 million shares of the 12.8 million shares set aside for them. This indicates 97 percent subscription.

Non-institutional investors have oversubscribed to 326 percent of the portion set aside for them. They have bid for 31.31 million shares against 9.6 million reserved. Meanwhile, employees have bid for 52 percent of the shares reserved for them.

January 31, 2023 / 03:23 PM IST

Vinod Nair, Head of Research at Geojit Financial Services

Economic survey is optimistic that India will continue to grow at a healthy rate in the medium term, led by consumption and capital expenditure. And the growth can expand to as high as 7 to 8 percent in the future.

The fundamentals of the Indian economy are solid, however, in the short to medium-term, widening current account deficit for an extended period is a concern that could have an implication on growth and depreciation of the INR.

For the budget, it is going to be a challenge in FY24 to plan out the expenditures due to a short-term slowdown in the economy, high core inflation, and fiscal deficit.

January 31, 2023 / 03:17 PM IST

BSE Capital Goods index rose 1 percent led by BHEL, Suzlon Energy, BEL

January 31, 2023 / 03:14 PM IST

Adani Enterprises FPO fully subscribed

The Follow-On Public Offering (FPO) of Adani Enterprises had got bids for 46.27 million shares against an offer size of 45.5 million shares, subscribed fully, on the third and final day of bidding.

January 31, 2023 / 03:09 PM IST

Ashwin Patil, Senior Research analyst at LKP Securities

Defence sector, as every year before the budget has a wishlist out of which the important one is outlay for emphasis on indigenisation, which means emphasis on local production. The GOI definitely does a lot for the sector every year, also on the R&D side where they plan to spend a substantial amount. Therefore even this year we expect them to announce a significant budget for the space and research, electronic equipment and advancement on further localization.

On PLI schemes we would say that the GOI is fostering healthy competition in the defence space through launching various PLI schemes. This would surely improve the quality of defence products and services and further enhance the defence sector. Also the country needs to improve on their space research, due to which we believe that further PLI schemes will be more focused on Space research.

January 31, 2023 / 03:05 PM IST

Adani Enterprises FPO subscribed 90% on Day 3

The Follow-On Public Offering (FPO) of Adani Enterprises had got bids for 40.78 million shares against an offer size of 45.5 million shares, representing a 90 percent subscription, in the afternoon of January 31, the third and final day of bidding.

This excludes the anchor portion that was fully subscribed.

Retail investors have taken a backseat as the stock price slid below the FPO price band, bidding for only 10 percent of the shares set aside for them.

Qualified institutional buyers (QIB) are at the forefront. They have bid for 12.44 million shares of the 12.8 million shares set aside for them. This indicates 97 percent subscription.

Non-institutional investors have oversubscribed to 271 percent of the portion set aside for them. They have bid for 26 million shares against 9.6 million reserved. Meanwhile, employees have bid for 46 percent of the shares reserved for them.

January 31, 2023 / 03:02 PM IST

Market at 3 PM

Benchmark indices were trading flat in the volatile session.

The Sensex was down 28.31 points or 0.05% at 59472.10, and the Nifty was down 6.30 points or 0.04% at 17642.70. About 2183 shares have advanced, 1065 shares declined, and 109 shares are unchanged.

Adblock test (Why?)

Closing Bell: Sensex, Nifty end with marginal gains; all eyes on Union Budget - Moneycontrol

Read More