The Reserve Bank of India (RBI) on October 31 identified nine banks to participate in commencing the first pilot of digital rupee in the wholesale segment.

The nine banks are State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC, the RBI said in a release. The pilot will commence on November 1.

According to the release issued on October 31, the use case for the wholesale pilot is settlement of secondary market transactions in government securities. Use of e₹-W, or wholesale, is expected to make the inter-bank market more efficient, the RBI said.

Settlement in central bank money would reduce transaction costs by pre-empting the need for settlement guarantee infrastructure or for collateral to mitigate settlement risk, the central bank said. Going forward, other wholesale transactions, and cross-border payments will be the focus of future pilots, based on the learnings from this pilot, it added.

The first pilot in Digital Rupee - Retail segment (e₹-R) is planned for launch within a month in select locations in closed user groups comprising customers and merchants, the RBI said, adding that the details regarding operationalisation of such a pilot shall be communicated in due course.

Central bank digital currency, or CBDC, is a currency that is backed by the regulator and stored in a digital format. It can be converted into paper currency and will reflect on the RBI’s balance sheet, thereby granting it legal tender status. India's CBDC will be called 'e₹'.

Union Finance Minister Nirmala Sitharaman on February 1 said the RBI will launch a CBDC in 2022-23, marking the first official statement from the Union government on the launch of the much-awaited digital currency. The FM had said introduction of CBDC will boost the digital economy and it will be based on the blockchain technology.

A CBDC is not a crypto currency. It is the digital form of legal tender and private virtual currencies are entirely different. Private virtual currencies are at substantial odds with the historical concept of money.

A CBDC is the digital form of fiat currency and will ease transactions. An RBI report had earlier described CBDC as something that will provide a safe, robust, and convenient alternative to physical cash. Depending on various design choices, it can also assume the complex form of a financial instrument, the RBI report said.

The RBI, in a concept note dated October 7, said it will soon start pilot launches of digital rupee for specific use cases. The concept note was released with an aim to provide a high-level view of motivations for the introduction of CBDC in India.SBI, HDFC Bank, 7 others identified for participation in digital rupee’s wholesale pilot: RBI - Moneycontrol

Read More

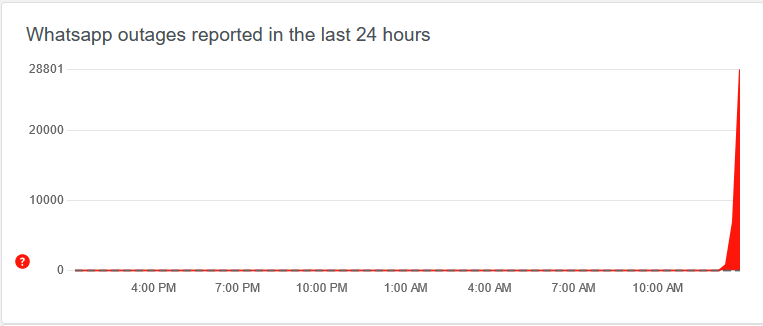

WhatsApp is down for thousands, with over 20,000 crash reports suggesting a major outage. (Image Source: DownDetector)

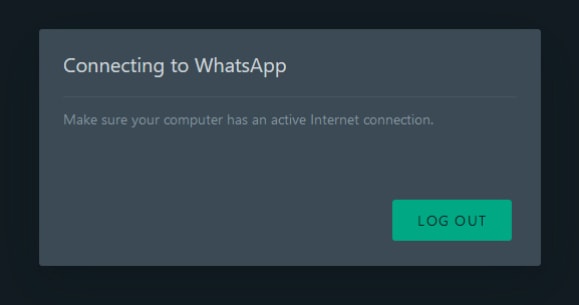

WhatsApp is down for thousands, with over 20,000 crash reports suggesting a major outage. (Image Source: DownDetector) WhatsApp Web is also not working, as people continue to wait for a fix for the outage. (Image Source: WhatsApp Web)

WhatsApp Web is also not working, as people continue to wait for a fix for the outage. (Image Source: WhatsApp Web)