In its latest monetary policy review, the RBI has done two things. One, raised the repo rate (or the rate at which it lends money to the banking system) by 50 basis points (or 0.5 percentage points). Two, it has cut India’s GDP growth rate for the current financial year (2022-23) from 7.2% to 7%.

Why did RBI cut the growth forecast?

Governor Shaktikanta Das started his statement by stating that the global economy is undergoing a third shock — after Covid and the war in Ukraine — and that this time it is a “storm” arising from aggressive monetary policy actions and even more aggressive communication from Advanced Economy (AE) central banks.

Simply put, when AE central banks, especially the US Federal Reserve, raise interest rates aggressively (in a bid to contain inflation in their economies) it also forces economies such as India to raise interest rates. If India does not then its currency would be even more under pressure and lose even more against the dollar because better returns in the US pull global investors out of emerging economies.

Subscriber Only Stories

But such aggressively tightening also slows down the respective economies. Given the fact that India’s Q1 GDP growth was slower than expected — India grew by 13.5% but RBI had expected it to grow by 16.2% — it was expected that India’s overall growth forecast of 7.2% might take a hit.

Another reason for cutting the growth forecast was the fact that since April when RBI first came out with the growth forecast of 7.2% for 2022-23, interest rates have gone up by a whopping 190 basis points. This had to take its toll on the growth rate regardless of the slower-than-expected Q1 data.

That is why Indian Express had reported that RBI will likely cut the growth rate.

How RBI has cut the growth rate by raising it

The Oddity

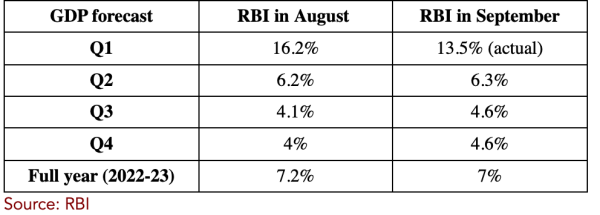

But, oddly enough, the RBI has arrived at a lower GDP growth rate for FY23 by actually raising the forecasts for the rest of the financial year (see Table).

Advertisement

In the August policy, RBI stated the following for growth forecast: “Taking all these factors into consideration, the real GDP growth projection for 2022-23 is retained at 7.2 per cent, with Q1 at 16.2 per cent; Q2 at 6.2 per cent; Q3 at 4.1 per cent; and Q4 at 4.0 per cent, and risks broadly balanced.”

In the September policy, released today, states: “Taking all these factors into consideration, real GDP growth for 2022-23 is projected at 7.0 per cent with Q2 at 6.3 per cent; Q3 at 4.6 per cent; and Q4:2022-23 at 4.6 per cent, with risks broadly balanced.”

It is unclear why RBI has revised the GDP growth upwards when it is dialling down the overall GDP growth rate and heading into a scenario when interest rates will continue to remain high.

How RBI has cut the growth forecast by raising it - The Indian Express

Read More