The much-awaited Maruti Suzuki Baleno update has just been launched with prices varying from Rs 6.35 lakh to Rs 9.5 lakh (ex-showroom). The facelifted, 2022 model comes with a smattering of cosmetic changes, along with a few key tech upgrades that have been installed to attract a younger set of buyers. Segment firsts including heads-up display, a 360-degree camera, 6 airbags etc., means the brand has been paying attention to its diminishing bottomline. However, the absence of a CVT gearbox option, mixed with the car’s relatively high price means the Baleno may not be the sure bet it once was. Just how well does it fare against the competition?

The Highlights

The facelifted 2022 Baleno comes in six variants: Sigma, Delta, Zeta, Zeta (O), Alpha and Alpha (O), powered by a 1.2-litre, four-cylinder petrol engine making 89bhp of peak power and 113 Nm of torque. The engine is standard across all variants. The top-end variants come with six airbags including curtain and side airbags (the Zeta variant gets this too), Heads-up-display, dual-tone alloy wheels and nine-inch touchscreen console, featuring the brand’s in-house SmartPlay Pro infotainment system (as opposed to the 7-inch Smartplay Studio system found on lower variants). Maruti Suzuki has removed the popular CVT gearbox that was earlier found in the Delta, Zeta and Alpha variants, instead opting for a more frugal AMT option. Other variants get a 5-speed manual.

An AMT box, while economical and cheaper to maintain, is sluggish and unrefined, requiring slow throttle inputs in order to function smoothly. Those looking for an automatic option (a growing tribe) will find themselves short-changed given that more sophisticated options can be found among rivals, chief of which being the Hyundai i20.

What’s heartening is that the new Baleno will also offer child seat anchorages, rear parking sensors, brake assist and dual airbags as standard. Design changes include a wider grille, LED DRLs, new tail lamps, new 16-inch alloys and better-cushioned seats. The Baleno can also be owned through Maruti Suzuki Subscribe at an all-inclusive subscription fee of Rs 13,999/month which covers complete registration, service & maintenance, insurance and roadside assistance.

Hyundai i20 Elite (Price range Rs 6.98 - Rs 11.47 lakh)

Pros: Looks, choice of powertrains, features

Cons: Expensive top-end models, entry-level variant not that appealing

Chief among its list of contenders is the formidable Hyundai i20 Elite. Although more expensive in top trim, there’s no taking away the fact that even in base trim the i20 looks more athletic and svelte. Available in three powertrains, starting from a less powerful, 81bhp 1.2-litre petrol unit and going up to a 118bhp, 1.0-litre turbo-petrol variant whose price starts at Rs 8.89 lakh (ex-showroom, undercutting the top-end Baleno) The variant also features a clutchless IMT gearbox which is convenient and frugal while also extracting greater performance.

In terms of safety features however, it loses out with only dual airbags, no child seat anchor points, leather-wrapped steering, rear A/C vents etc. For that, you have to opt for the variants at the top-end, the most expensive of which hits the Rs 11.47 lakh mark. If performance and style are priority, the i20 is the car to go for. If features and fuel economy at a relatively low price are the chief factor, go for the Baleno.

In terms of safety features however, it loses out with only dual airbags, no child seat anchor points, leather-wrapped steering, rear A/C vents etc. For that, you have to opt for the variants at the top-end, the most expensive of which hits the Rs 11.47 lakh mark. If performance and style are priority, the i20 is the car to go for. If features and fuel economy at a relatively low price are the chief factor, go for the Baleno.

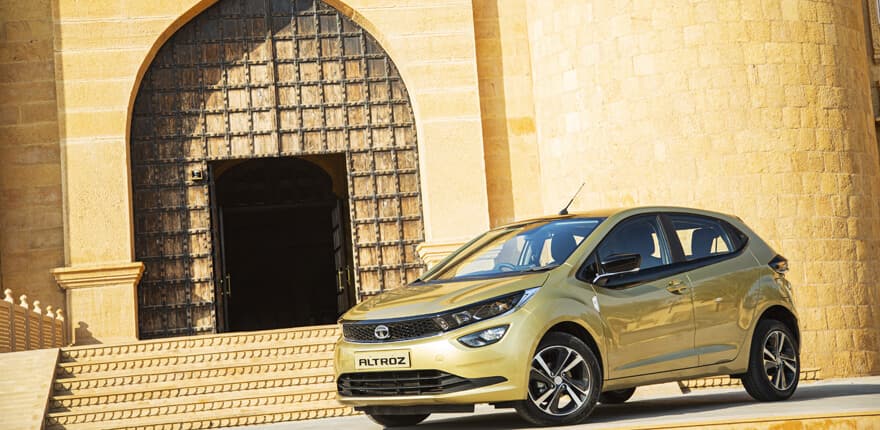

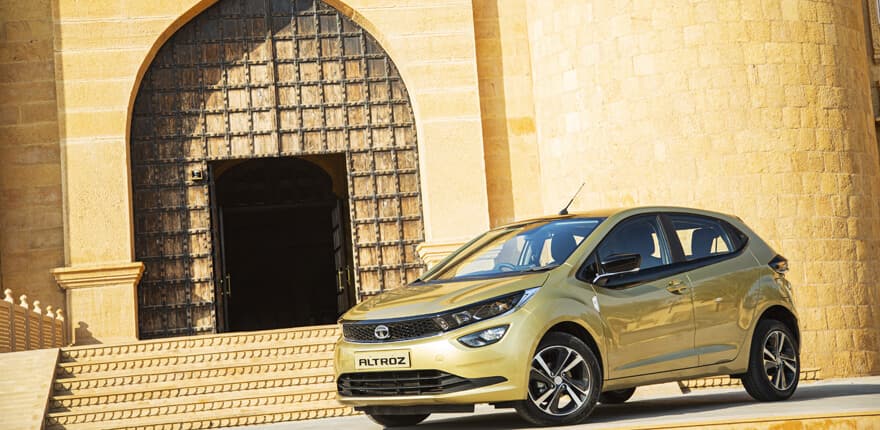

Tata Altroz (Price range: Rs 5.99 lakh - Rs 9.69 lakh)

Pros: Style, safety, price

Cons: No automatic variant yet, infotainment options could be better

Easily the best-looking premium hatchback in the segment, the Altroz also has a certified 5-star Global NCAP safety rating. The Altroz also comes with a more enticing set of powertrains, including a 1.5-litre diesel (much like the i20), a 108 hp 1.2-litre turbo-petrol and an 82bhp 1.2-litre petrol that competes directly with the likes of the Baleno.

Where the Altroz loses out is its lack of an automatic option, lacklustre infotainment system and feature list that doesn’t quite stack up against the 2022 Baleno’s. Its safety rating, however, is the best-in-class and something worth considering while making your next purchase.

Honda Jazz (Price range: Rs 7.81 lakh to Rs 9.95 lakh)

Pros: Safety, reliability, space

Cons: Lackluster infotainment options

The Honda Jazz, which recently secured a 4-star safety rating in the Global NCAP test, has suddenly risen in the esteem of many-a-car buyers. Its trademark Honda reliability levels, excellent passenger and storage space make a strong case for it, while its 1.2-litre petrol engine with 88bhp of power puts it squarely in the Baleno’s league of performance. Its infotainment options may not be as up-to-date as the Baleno’s but the Jazz edge’s ahead due to its safety credentials.

Toyota Glanza (Price Rs 7.7 lakh - Rs 9.66 lakh)

Pros: Continues to offer CVT version (for now)

Cons: Same as the Baleno’s

Last but not the least is the Baleno’s badge-engineered identical twin: the Glanza. Featuring the same powertrain, the Glanza doesn’t quite benefit from Toyota’s famed reliability levels since it is in every sense, a Baleno. In fact, given that it hasn’t been updated with the 2022 model’s feature list, the Glanza falls significantly lower down the pecking order and should be considered only for the CVT option and Toyota badge value.

NOTE: The VW Polo, although still competing in the segment, has been excluded from this list because VW has announced that the Polo’s 12-year run in India will be coming to an end.

Adblock test (Why?)

Maruti Suzuki Baleno vs competition | How the facelifted 2022 model fares against peers - Moneycontrol.com

Read More

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DMH7P4NX7JJENKBWYBPYH3SOTU.jpg)

In terms of safety features however, it loses out with only dual airbags, no child seat anchor points, leather-wrapped steering, rear A/C vents etc. For that, you have to opt for the variants at the top-end, the most expensive of which hits the Rs 11.47 lakh mark. If performance and style are priority, the i20 is the car to go for. If features and fuel economy at a relatively low price are the chief factor, go for the Baleno.

In terms of safety features however, it loses out with only dual airbags, no child seat anchor points, leather-wrapped steering, rear A/C vents etc. For that, you have to opt for the variants at the top-end, the most expensive of which hits the Rs 11.47 lakh mark. If performance and style are priority, the i20 is the car to go for. If features and fuel economy at a relatively low price are the chief factor, go for the Baleno.