The market erased all its previous day's gains and declined 1 percent on January 27, the expiry day for January derivative contracts. Sectorally, the Nifty IT index fell the most, down 3.55 percent, followed by FMCG, Pharma, and Realty indices that slipped 1-2 percent.

Consistent FII selling, hawkish Fed commentary after monetary policy meeting, and rising crude oil prices weighed on sentiment.

The BSE Sensex plunged 581.21 points to 57,276.94, while the Nifty50 declined 167.80 points to 17,110.20 and formed a bullish candle on the daily charts as the closing was higher than opening levels.

"The Nifty has maintained its lower top lower bottom formation of the daily charts, however, it has managed to sustain above 17,000 mark consistently for the last 3 sessions and formed a reversal candle patterns like Piercing Line and Hammer candle pattern on the daily charts, indicating some kind of bottoming out for the short to medium term," says Vidnyan Sawant, AVP - Technical Research at GEPL Capital.

He further says the RSI (relative strength index) indicator on lower timeframes has been placed below 40-mark; however, it is showing price momentum divergence.

"The Nifty has resistance at 17,450 and 17,776 levels whereas the support lies at 16,836 mark. The index shows initial signs of bottoming out near 17,000 mark and could give a pullback towards 17,450-17,776 levels. On the flip side, if index breaks below 16,836 then it can move lower towards 16,600 – 16,410 levels," says Sawant.

The broader markets also fell sharply with the Nifty Midcap 100 and Smallcap 100 indices declining 1.05 percent and 0.73 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,923.83, followed by 16,737.47. If the index moves up, the key resistance levels to watch out for are 17,239.53 and 17,368.87.

Nifty Bank

The Nifty Bank outperformed benchmark indices, rising 275.35 points to 37,982.10 on January 27. The important pivot level, which will act as crucial support for the index, is placed at 37,280.33, followed by 36,578.56. On the upside, key resistance levels are placed at 38,415.73 and 38,849.37 levels.

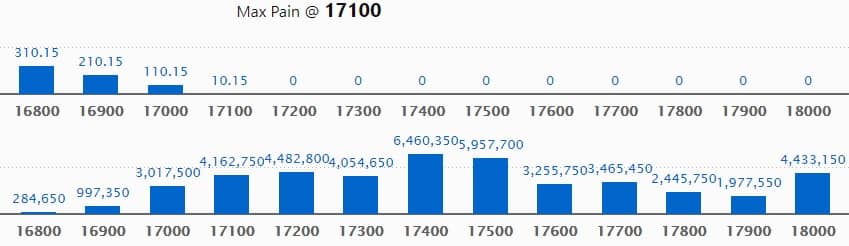

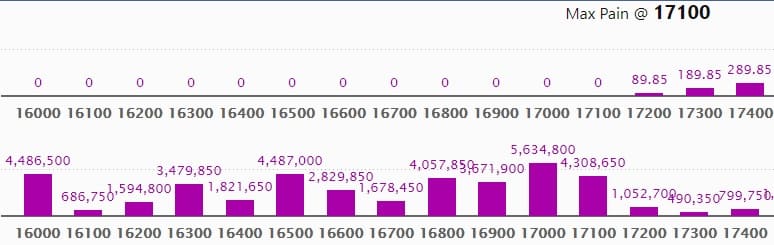

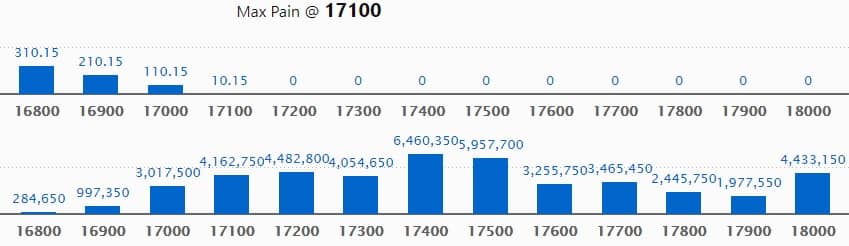

Call option data

Maximum Call open interest of 64.60 lakh contracts was seen at 17,400 strike, which will act as a crucial resistance level in the February series.

This is followed by 17,500 strike, which holds 59.57 lakh contracts, and 17,200 strike, which has accumulated 44.82 lakh contracts.

Call writing was seen at 17,400 strike, which added 32.20 lakh contracts, followed by 17,100 strike which added 28.88 lakh contracts, and 17,200 strike which added 18.96 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 41.91 lakh contracts, followed by 17,600 strike which shed 24.57 lakh contracts and 17,800 strike which shed 22.99 lakh contracts.

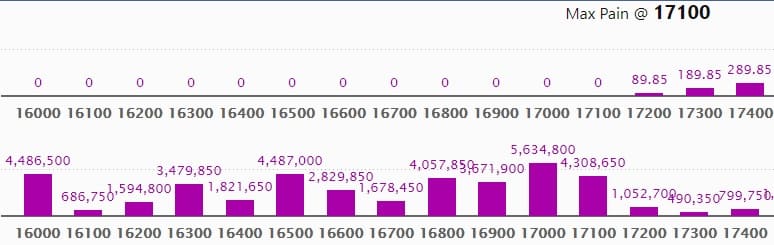

Put option data

Maximum Put open interest of 56.34 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the February series.

This is followed by 16,500 strike, which holds 44.87 lakh contracts, and 16,000 strike, which has accumulated 44.86 lakh contracts.

Put writing was seen at 17,100 strike, which added 16.52 lakh contracts, followed by 16,300 strike, which added 15.86 lakh contracts, and 16,900 strike which added 10.35 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 19.42 lakh contracts, followed by 16,000 strike which shed 13.84 lakh contracts, and 17,300 strike which shed 9.96 lakh contracts.

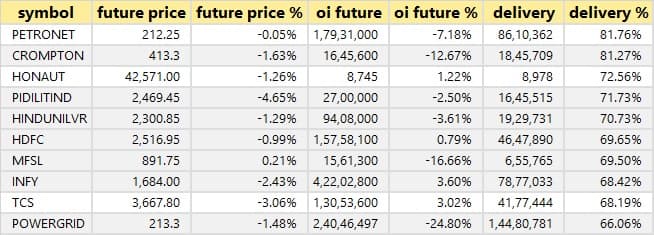

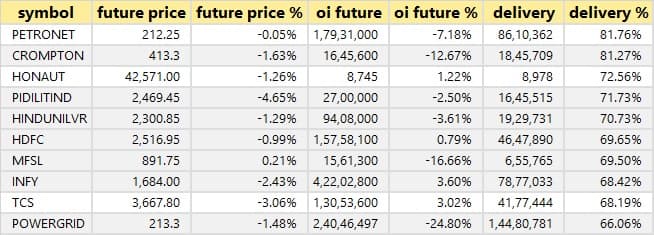

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

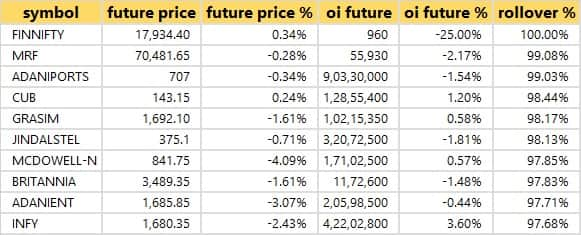

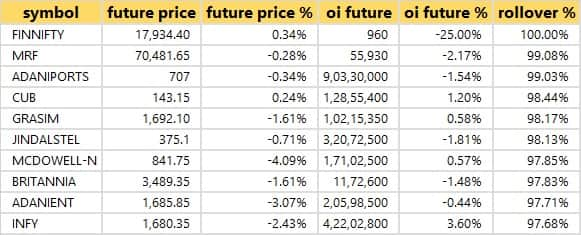

Rollovers

4 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the four stocks in which a long build-up was seen.

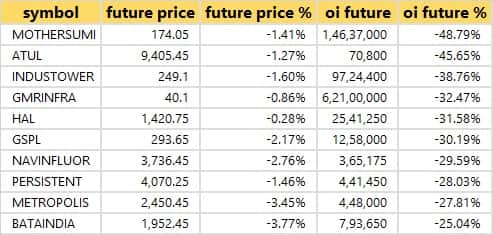

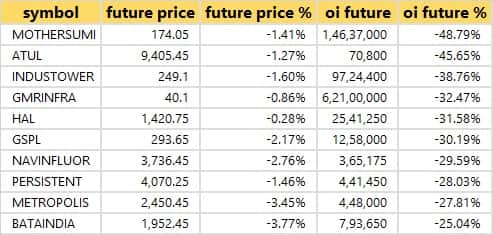

136 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

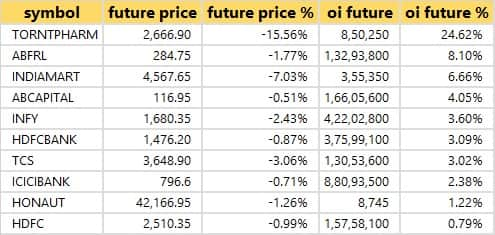

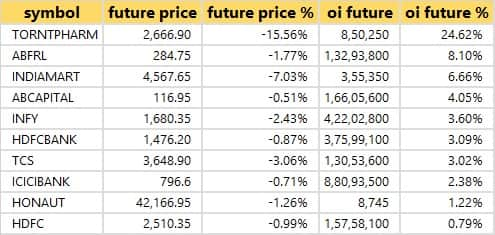

16 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

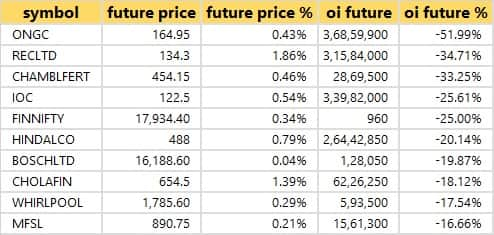

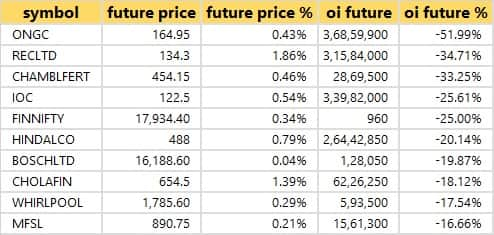

44 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

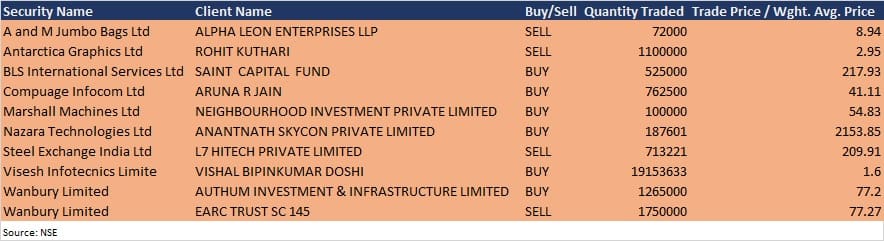

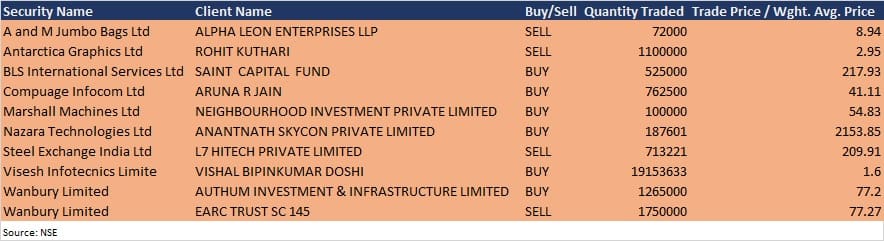

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 28 and January 29

Results on January 28: Larsen & Toubro, Dr Reddy's Labs, Kotak Mahindra Bank, Britannia Industries, Vedanta, 3i Infotech, Aptus Value Housing Finance, Arvind SmartSpaces, Asahi India Glass, Atul, AU Small Finance Bank, Bajaj Healthcare, Bharat Electronics, Blue Dart Express, CARE Ratings, Central Bank of India, Chambal Fertilisers, Chemplast Sanmar, Crompton Greaves Consumer Electricals, Deepak Fertilisers, Dixon Technologies, Equitas Small Finance Bank, Happiest Minds Technologies, Karnataka Bank, Marico, Max Financial Services, Info Edge, Oberoi Realty, Suzlon Energy, Tata Coffee, United Breweries, UTI Asset Management Company, and Zenotech Laboratories will release their quarterly earnings on January 28.

Results on January 29: IndusInd Bank, NTPC, Amber Enterprises India, Geojit Financial Services, Godfrey Phillips India, Gravita India, Heranba Industries, MCX India, Neogen Chemicals, Rossari Biotech, Unichem Laboratories, Vipul Organics, and Zen Technologies are slated to annoubce their quarterly earnings on January 29.

Chalet Hotels: The company's officials will meet analysts and investors on January 28 to discuss financial results.

Polycab India: The company's officials will meet ICICI Securities on January 28.

Cigniti Technologies: The company's officials will meet analysts and investors on January 31, to discuss financial results.

Info Edge: The company's officials will meet analysts and investors on January 31, to discuss financial results.

Tata Motors: The company's officials will meet analysts and investors on January 31, to discuss financial results.

VIP Industries: The company's officials will meet analysts and institutional investors on February 2 to discuss financial performance.

Mahindra & Mahindra Financial Services: The company's officials will meet analysts and investors on February 2, to discuss financial results.

Syngene International: The company's officials will meet Franklin Templeton on February 4.

Wipro: The company's officials will attend 17th Edelweiss India Conference 2022 on February 7, PL 2022 Tech Tonic Conference on February 8, Antique's Annual Investor Conference on February 9, and Axis Capital India Conference on February 15.

Hitachi Energy India: The company's officials will meet analysts and investors on February 9, to discuss financial results.

Stocks in News

Punjab National Bank: The bank reported profit of Rs 1,126.8 crore for Q3FY22 against Rs 506 crore in Q3FY21. The net interest income fell to Rs 7,803.2 crore from Rs 8,345.8 crore YoY.

Indus Towers: The company reported higher profit at Rs 1,570.8 crore in Q3FY22 against Rs 1,558.5 crore in Q2FY22, revenue rose to Rs 6,927.4 crore from Rs 6,876.5 crore QoQ.

KEI Industries: The company reported sharply higher profit at Rs 101.2 crore in Q3FY22 against Rs 76.2 crore in Q3FY21, while revenue jumped to Rs 1,563.8 crore from Rs 1,152.9 crore YoY.

Route Mobile: The company posted higher profit at Rs 48.2 crore in Q3FY22 against Rs 37.6 crore in Q3FY21, revenue surged to Rs 562.7 crore from Rs 384.8 crore YoY.

RBL Bank: The bank reported higher profit at Rs 156.1 crore in Q3FY22 against Rs 147.1 crore in Q3FY21, net interest income rose to Rs 1,010.4 crore from Rs 908.2 crore YoY.

Home First Finance Company: The company posted sharply higher profit at Rs 45.9 crore in Q3FY22 against Rs 15.9 crore in Q3FY21, revenue increased to Rs 151.68 crore from Rs 110.26 crore YoY.

KPR Mill: The board of directors will consider buyback of shares on February 7.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 6,266.75 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,881.32 crore in the Indian equity market on January 27, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Adblock test (Why?)

Trade setup for Friday: Top 15 things to know before Opening Bell - Moneycontrol.com

Read More